Will Rice the Next Source of Philippine Food Inflation?

Thailand's rice prices have been soaring. US rice futures market attempting a breakout. How will this impact the Philippines?

This media op-ed suggests that garlic could be the next food item to experience a shortfall in supply after onions.

Inquirer.net, January 27: While Filipino consumers slowly try to recover from months of inexplicably high onion prices, some are now bracing for higher costs of another kitchen staple—garlic—as a supply shortage lurks around the corner.

Instead, could a rice crisis 2.0 be next?

Bloomberg, January 27:

Rice prices are climbing, a sign that the food inflation shock that threw millions into poverty is still reverberating, even as the cost of wheat and other farm commodities has declined.

Thai rice, a benchmark for Asia, has soared to the highest in almost two years. Strong demand lies at the heart of the rally, with some importers buying more of the grain to replace wheat after the war in Ukraine disrupted supplies. Some consumers have also been stocking up ahead of festivals, while a strengthening Thai currency has also helped to push up dollar-denominated prices.

Rice is a staple for half the world, and while wheat soared to a record in March last year, rice was relatively subdued for most of 2022, constraining food inflation in Asia. Costlier rice now will be unwelcome news for billions of people from China to India and Vietnam.

Rice prices have been climbing not just in Asia but in the US too. (Rice futures USD/CWT or hundredweight)

Aside from the above, the recent spike in fertilizer prices, increasing global regulatory trade restraints, a manifestation of protectionism, have escalated supply pressures, as discussed here and here.

Increased demand from 'financial loosening' could also be the latest factor.

That is to say, should global imbalances of rice be sustained, expect upside volatility in rice prices.

How will this affect the Philippines?

The Philippine agricultural industry is heavily regulated or suffers from protectionism.

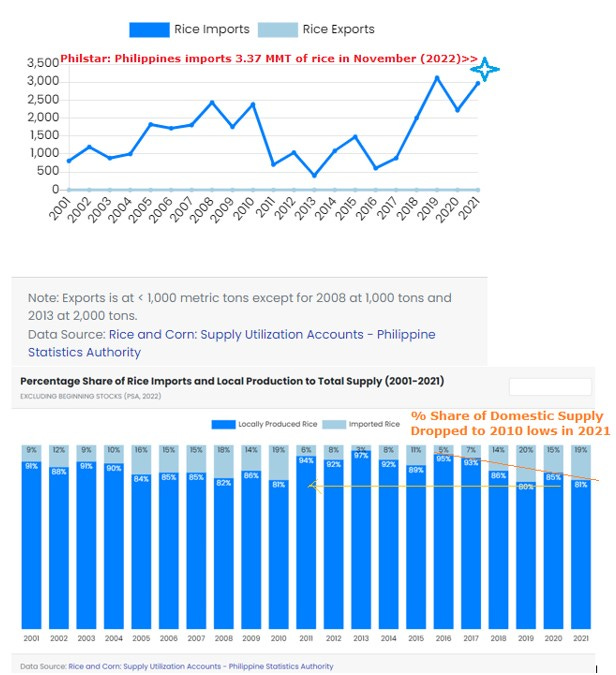

Regulated imports are, thus, a response to the erosion of the % share of domestic supply, which has dropped in the last six years and reached a 2010-low in 2021. Or imports constitute about 20% of rice supplies/requirements.

As of November, rice imports hit 3.37 million metric tons.

Thailand represented the third largest source of Philippine rice imports after Vietnam and Myanmar in 2022.

The USDA projected rice imports in 2023 at 3.4 million metric tons.

Finally, rice prices have an 8.87% weight in the Philippine CPI basket, the third largest after rent (12.82%) and food and beverage (9.47%).

So, material increases in its price will likely impact the CPI substantially.

Worse, it will push higher hunger incidents nationwide that could amplify risks of social unrest.