The Property Index Trailed the PSEi 30; How the Top 5 Biggest Philippine Property Developers Performed in 2022 (in Total)

Since 2019, the property index trailed behind its peers at the PSE. Despite the inflationary boom of 2022, the financial performance of the top 5 developers reveals part of this reason.

One of the foremost concerns of all parties hostile to economic freedom is to withhold this knowledge from the voters. The various brands of socialism and interventionism could not retain their popularity if people were to discover that the measures whose adoption is hailed as social progress curtail production and tend to bring about capital decumulation. To conceal these facts from the public is one of the services inflation renders to the so-called progressive policies. Inflation is the true opium of the people and it is administered to them by anticapitalist governments and parties—Ludwig von Mises

In this issue

The Property Index Trailed the PSEi 30; How the Top 5 Biggest Philippine Property Developers Performed in 2022 (in Total)

I. Despite the 2022 Inflationary Boom: The Property Index Trailed the PSE

II. Property Bubbles Lowers the Standard of Living through Capital Consumption and Redistribution

III. As Collateral for Bank Lending, the BSP Defends Real Estate Values to Safeguard the Banking System

IV. The 2022 Financial Performance of the Top 5 Biggest Developers: Rental Revenues Insufficient to Fill the Slack in Real Estate Sales as Debt Soared

___

The Property Index Trailed the PSEi 30; How the Top 5 Biggest Philippine Property Developers Performed in 2022 (in Total)

I. Despite the 2022 Inflationary Boom: The Property Index Trailed the PSE

The 2022 epic inflationary boom signified a rara avis.

From a financial performance standpoint, almost all sectors benefited from credit-driven inflation but varied by degree and time. And the annual 7.6% GDP manifested such lavishness in spending by a segment of consumers and the government.

Despite its disappointing performance at the PSE, the real estate industry likewise benefited from credit-fueled improvements last year.

First, the property sector has trailed behind its peers in the PSE.

As of March 2023, while the PSEi logged a 9.8% deficit YoY, the property sector brought up the rear with a 19.21% loss.

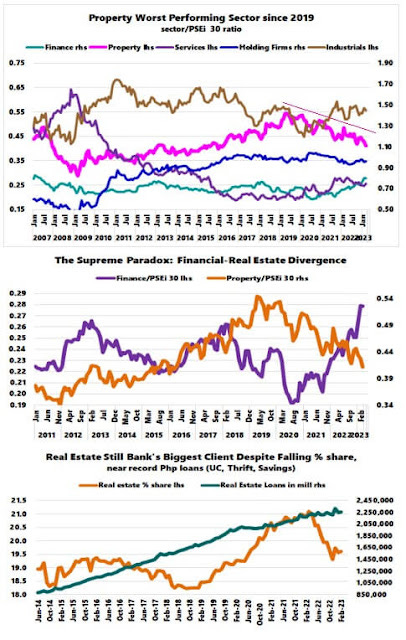

Figure 1

As a ratio to the PSEi 30, since the nadir of March 2020, only two sectors have remained below this level, the holding firm (-2.11%) and the property sector (-20.21%)—which means that these sectors have dragged the headline index down. (Figure 1, topmost chart)

On the other hand, the finance and industrial indices signified the clear winners, up 21.14% and 20.98%.

The supreme paradox is that while financials provided a significant premium to investors, its biggest client, the property sector, endured heavy losses. (Figure 1, middle pane)

And while the property sector's share of the banking industry's loans has recently languished—as others outperformed—its portfolio remains the largest.

After reaching a high of 21% of the total banking portfolio in the first semester of 2022, its share plunged to 19.6% last February 2023. (Figure 1, lowest diagram)

Figure 2

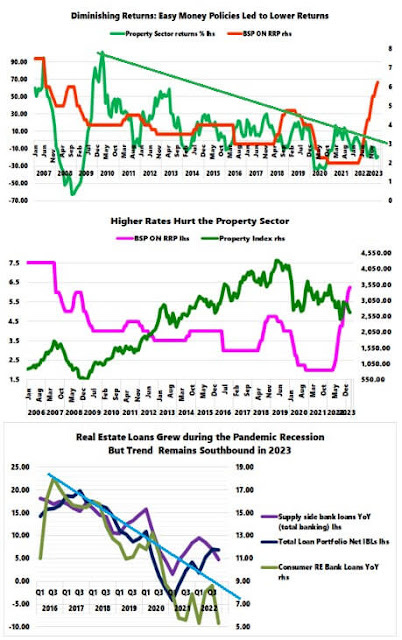

But the thing is, even as the property index ascended (from 2009-2019) as the BSP undertook a series of rate cuts to its lowest level, diminishing returns afflicted the sector, or its rate of returns cascaded over time. (Figure 2, topmost window)

Or, in the heydays of easy money, although the property sector outperformed the PSEi 30 during that period, investors got less and less payback from their exposure to this sector.

Worst, the industry failed to join its peers to the upside when the BSP launched a package of unprecedented price stability measures or the monumental rescue of the banking system in 2020. Or, although the tsunami of liquidity cushioned the sector from further decline, its recovery was restricted.

And yet, the high cost of money today, represented by the multi-year high BSP ON RRP rates, could burden the credit-addicted economy. It could weigh substantially on the property sector. (Figure 2, middle chart)

And its equity underperformance may have exhibited this encumbrance.

As a caveat, the PSE has constantly changed the constituency of the Property Index at the margins. So, the price trend of the property index does not represent an apples-to-apples picture.

At present, there are 17 members, including REITs. These are Ayala Land, AyalaLand Logistics, AREIT, Cebu Landmasters, Century Properties, Double Dragon, DDMP REIT, DM Wenceslao, Filinvest REIT, Filinvest Land, Megaworld, MREIT, Primex Corporation, RL Commercial REIT, Robinsons Land, SM Prime, and Vista Land.

Bank lending growth rate to the consumer and supply-side of the property sector has also been fading, which represents an ominous sign to the industry's economics. (Figure 2, lowest diagram)

Importantly, the diminishing returns have not been exclusive to the property sector but to the headline index as well.

To this end, not just escalating erosion of returns but mounting risks confront investors.

II. Property Bubbles Lowers the Standard of Living through Capital Consumption and Redistribution

But there is more.

Yet, the betting public has been yearning for sustained increases in property prices or programmed to believe that property rises can only rise—as if the permanence of property inflation would magnify the faltering returns and boost economic prosperity.

These people fail to comprehend its many social costs, including the declining affordability of homeownership or rent that penalizes the low and middle class and the redistribution of gains or benefits from the average residents to big-time developers and speculators—who siphon away property liquidity by restricting or withholding inventories out of the marketplace—to push prices higher.

And with the rising cost of residency, demand for public housing also increases, which forges and intensifies politicization, centralization, and worsens the redistribution to select political constituencies at the expense of the middle and lower-income/wealth segments. Increased demand for public housing thus competes and crowds out the private sector. Nice huh?

People also forget that buying high to sell higher are likely manifestations of the hot potato effect—getting rid of money by chasing yields, and the "greater fool theory"—selling overpriced assets to a "greater fool"—which are merely symptoms of credit-fueled asset bubbles.

The Austrian-American economist Fritz Machlup analogized how the money illusion or asset bubbles causes capital consumption.

A dealer bought a thousand tons of copper. He sold them, as prices rose, with considerable profit. He consumed only half of the profit and saved the other half. He invested again in copper and got several hundred tons. Prices rose and rose. The dealer’s profit was enormous; he could afford to travel and to buy cars, country houses, and what not. He also saved and invested again in copper. His money capital was now a high multiple of his initial one. After repeated transactions—he always could afford to live a luxurious life—he invested his whole capital, grown to an astronomical amount, in a few pounds of copper. While he and the public considered him a profiteer of the highest income, he had in reality eaten up his capital.

Carried through its logical conclusion, while rising prices continue to project a mirage of profit, the rising costs of copper limit the dealer's ability to replace inventories, i.e., from a thousand to a hundred tons, then to a few pounds—thereby consuming his/her capital.

And this "money illusion" phenomenon should play a vital role—not only in real estate and capital markets—but also in the general economy.

Like the stock market, the real estate industry has increasingly morphed into a gambler's den or a casino.

And asset bubbles are also signs of systemic credit-financed malinvestments, absorbing excess resources and finances at the expense of other industries (such as the agriculture, materials sectors, and others) induced primarily by BSP easy money policies.

But has the consensus responsibly apprised the public of such entropic conditions from a real estate bubble, or are they cheerleaders of vested interest groups preaching phantasmagoric utopia?

This article glamorizes the consumer’s capacity to prodigiously borrow and spend their way to financial prosperity, while ignoring the risks to duration, supply issues, inflation and personal/household balance sheets (bold mine): "CAR and home loans in the Philippines are jumping while credit cards are being swiped relentlessly to pay for travel and dining in signs that 16-year-high borrowing costs aren’t deterring Filipinos from spending…That’s good news for the Philippines’ consumption-driven economy, which the government expects to grow as much as 7 per cent in 2023 – slower than last year’s 7.6 per cent but still among Asia’s bright spots. Economic managers see retail spending withstanding elevated inflation, which cooled to a six-month low in March, but is still well above the central bank’s 2 per cent-4 per cent target for the year."

Let us see how such claims measure up in a year's time.

III. As Collateral for Bank Lending, the BSP Defends Real Estate Values to Safeguard the Banking System

As collateral, real estate values represent a foundation of bank credit transactions. The higher the price of real estate, the higher its collateral value, which increases the bank's capacity to lend and the borrower's ability to absorb increased credit. These represent "liquidity."

Thus from BSP's perspective, collateral values must never suffer from deflation. Otherwise, the deflation of collateral values could transform into a "systemic risk" for the banking system.

So even when the bank credit shrank during the 2020 pandemic recession, the BSP ensured a historic flow of liquidity to this credit-sensitive sector through the banking system.

Consumer real estate bank lending expanded—even as almost all others—contracted. (see also Figure 2, lowest chart)

Figure 3

Nonetheless, measured by the BSP Real Estate Index, real estate prices climbed in 2022. The national housing index expanded by 7.7% YoY in Q4, even as the benchmark 10-year Treasury rose. (Figure 3, topmost window)

Yes, bank lending to the real estate sector has, so far, defied the law of demand.

Instead of supply and demand side bank borrowing, the Real Estate Index chimed with the TOTAL bank lending. (Figure 3, middle pane)

It implies of possible diversion of a substantial segment of bank borrowing, declared for the use of other sectors, but redirected toward property speculation.

Property values for NCR grew by 16.2% YoY in Q4, according to the Bank for International Settlements (BIS), while the BSP's NCR Index expanded by 4.8%. (Figure 3, lowest chart)

The variance between the BIS and BSP indices is substantial. The jury is out on which index represents the nearest estimate of reality.

But as 2022 data revealed, the diffusion of monetary inflation has been widespread. Aside from goods and services, it includes national real estate prices, which signifies aggregate interactions of formal property developers, the secondary markets, and mom-and-pop developers, speculators, and landlords.

Since collateral values drive a substantial segment of credit expansion, the BSP will likely sacrifice the currency's purchasing power to save banks by bolstering the real estate industry through munificent access to liquidity and credit. That would be the tacit metaphysical goal, but the markets have been pushing back against it.

Finally, protecting the real estate and banking industry underlies the principle behind the vehement opposition to hybrid, telecommuting, or remote work. A drastic change in consumer preferences on work locations will cause substantial dislocations into the "sunk costs" structured on traditional models of real estate operations. Vested interest groups will use politics to protect their turfs.

IV. The 2022 Financial Performance of the Top 5 Biggest Developers: Rental Revenues Insufficient to Fill the Slack in Real Estate Sales as Debt Soared

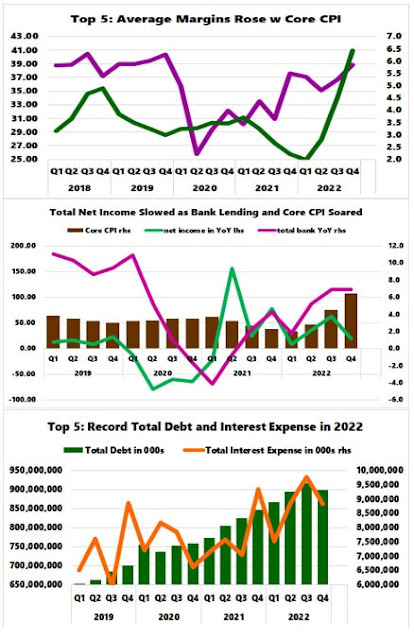

Figure 4

The above perspective brings us to the 2022 financial performance of the top 5 property developers (in the context of asset prices and market capitalization), namely, SM Prime Holdings, Ayala Land, Megaworld, Robinsons Land, and Vista Land.

Though aggregate revenues spiked by 21% in Q4 2022—the most in 2022—it was still 10.98% below the Q4 2019 level. (Figure 4, topmost window)

And rent income closely tracked the booming consumer credit in 2022. (Figure 4 middle chart)

The FOMO (Fear of Missing Out) in rent revenues hit a high of 63.8% in Q3. It grew by a brisk 51.5% in Q4 as consumer credit growth sprinted to a 2-year high rate!

On the other hand, real estate sales grew by 24.24% in Q3 but slowed to 10.7% in Q4. Real estate revenues partly resonated with the seeming plateauing growth in total bank loans at 6.92% in Q3 and 6.9% in Q4 2022. (Figure 4, lowest window)

Real estate revenues (in pesos) remained 19.6% below the Q4 2019 levels.

This being so, the spike in rental revenues was insufficient to fill the slack left by real estate sales.

Figure 5

But the average profit margins of the top 5 developers improved along with the CORE CPI in 2022. (Figure 5, topmost chart)

As a result, the industry's published net income grew by 63.2% in Q3, then decreased to 19.9% in Q4. (Figure 5, middle window)

Alternatively explained, companies owned by the elite listed firms (retail, property, and banks) benefited enormously from credit inflation—also expressed as the CPI.

The irony is, at the same period, about half of the Filipino households declared they were in poverty! Again, inflation exhibits a massive wealth transfer—a reverse Robinhood.

Of course, the property sector is probably the most leveraged.

Leverage anchors its end-to-end business process: namely, sales, architectural design, materials mobilization, construction, subcontracting, equipment rentals, interior design, and more.

At any rate, debt from the top 5 of the industry's supply side hit a record in 2022, specifically in Q3. An incredible expansion in debt encompassed the sector as it benefited from the inflationary boom of 2022. (Figure 5, lowest diagram)

Interest expenses also hit a landmark in 2022. And interest expense likely reflects only the debt load with the BSP's panic rate hikes in 2H of 2022 yet to percolate into their financial statements.

A tenuous topline heavily dependent on sustained bank credit expansion in the face of rising rates, volatile input cost and margins from price instability, higher interest expense from increasing debt loads, and rising rates subject the industry to increased fragility. Or, the risk to the downside seems greater than the upside.

All these resonate with or affirm my earlier analysis of Robinsons Retail and Robinsons Land. (Prudent Investor, 2023)

Again, micro developments resoundingly manifest the macro scenario. So statistics only validate people's actions and responses to policies and vice versa (feedback loops).

In the end, with the consensus thinking still buried in the sand, how would a reckoning unfold when reality forces the world to wake up from their pipe dreams?

Or could this time be different?

___

references

F. Machlup, “The Consumption of Capital in Austria,” The Review of Economic Statistics (January): pp. 13–19.

Prudent Investor, Robinsons Retail’s Record-Breaking 2022 Performance Reveals the Shifting Nature of Inflation April 3, 2023: Substack, Blogger

Prudent Investor, Robinsons Land’s 2022 Record Revenues and Income Bolstered Mainly by Consumer Credit Expansion April 13, 2023: Substack, Blogger