The Fundamental Story Behind the 6.4% Q1 2023 Philippine GDP: Public Spending Cushioned a Slowing Consumer

The Philippine 6.4% Q1 2023 GDP slowed but beat expectations. But credit-financed "revenge" consumer spending appears to have peaked as public spending cushioned the slowdown. More below...

…the whole idea of GDP gives the impression that there actually is such a thing as the national output. In the real world, however, wealth is produced by someone and belongs to somebody. We’re not ants or bees working for the hive. The whole idea of a GDP just allows the “authorities” to bamboozle people into believing they can actually control “the economy,” as if it were some giant machine—Doug Casey

In this issue:

The Fundamental Story Behind the 6.4% Q1 2023 Philippine GDP: Public Spending Cushioned a Slowing Consumer

I. Statistics and their Stories: Self-Rated Poverty and Hunger

II. Sorry But Q1 2023 GDP Reinforces the Secondary (Slower) Trendline

III. The Fundamental Story Behind Q1 2023 GDP: Public Spending Cushioned the Slowing Consumer

IV. The Public Sector and Construction GDP Boom

V. Q1 2023 GDP: A Peak in Consumer Spending? Bank Credit, Retail Sales and GDP in Chorus

VI. Public Spending GDP Bounce? But the Bureau of Treasury’s Data Showed Negative Public Spending Growth

VII. Lower GDP from Slight Decline in NGDP and Higher Inflation, the Increasing Dominance of the Banking System, L-Shape per Capita Data

____

The Fundamental Story Behind the 6.4% Q1 2023 Philippine GDP: Public Spending Cushioned a Slowing Consumer

I. Statistics and their Stories: Self-Rated Poverty and Hunger

Statistics are not just about numbers, but they have stories to tell.

Whether or not the stories are contrived to influence public opinion is for the audience to decipher.

For instance, a private polling firm recently showed that self-rated poverty among households remained at 51% in Q1 2023, although slightly higher compared to Q4 2022.

The same firm later reported that hunger affected 9.8% of families in March compared to 11.8% in December 2022—a substantial improvement! Though both relate to sentiments, one addresses food deprivation while the other describes general hardship.

As it is, the divergent polls didn't say how and why the supposed "improvements" occurred even as inflation raged. The average inflation rate of Q4 2022 was 7.9%; it climbed to 8.3% in Q1 2023. Could it have been that the higher the inflation, the better the sentiment?

Or has there been an avalanche of high-paying jobs made available during this period? Unfortunately, the employment rate dropped to 95.3% in March 2023 from 95.7% in December 2022. Or, the number of people employed shed by some 421,350, covering about 102.8 thousand families/households (4.1 people per household), according to the labor survey of the PSA.

Or could the government's Php 1K inflation ayuda subsidies for target families have been enough to improve hunger and self-improved poverty ratings?

Or was the tooth fairy responsible for it?

The point of the above is that the surveys attempted to exhibit the presumed "resilience" of the citizenry in coping with inflation—true or not.

II. Sorry But Q1 2023 GDP Reinforces the Secondary (Slower) Trendline

That said, the GDP is also calculated based on an aggregation of surveys.

Q1 2023 GDP of 6.4%, which slowed compared to the recent past, was better than consensus estimates. It also had a narrative.

Generally, with consumers harried by inflation, public spending, supported by construction, rode to rescue the proverbial damsel in distress. Though little discussed by the mainstream, the PSA's data depicts such dynamics.

For starters, let us deal with last year's outgrowth.

True, the base effects magnified the impact of the transition to the gradual reopening of the economy from the pandemic shutdown through the outstanding GDP numbers (quarterly and annual) in 2022. Yes. Yyyyuge growth numbers!

But here is the thing. Despite the mainstream's din over the GDP, their trendline reveals a different angle.

Figure 1

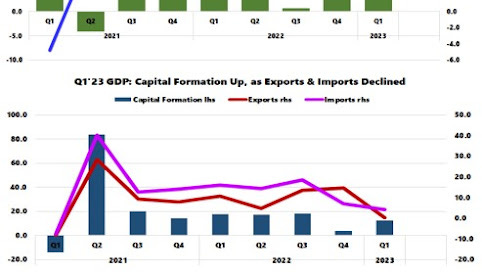

Following the Q2 2020 plunge, the series of "high trajectory" numbers of 2022 failed to regain the primary trend of the NGDP and real GDP. Instead, Q1 2023's GDP reinforced the secondary trendline, which indicates a slower pace of GDPs ahead. That's even in the assumption that this trendline holds. (Figure 1, topmost chart)

Worst, if 2022's high-octane GDP had been a product of the "low" base effects, the same "high" base effects could provide tenuous support for the secondary trendline.

In a way, the above demonstrates statistics and their supposed stories, which ironically contravene the interpretations of the consensus.

III. The Fundamental Story Behind Q1 2023 GDP: Public Spending Cushioned the Slowing Consumer

At any rate, the expenditure distribution represents a concise vista of the GDP.

The headline household consumption grew 6.3% in Q1 2023, substantially lower from 7% in Q4 2022 and 10% in Q1 2021. That's a substantial growth markdown of 9% from Q4 and 36% from the same period a year ago! (Figure 1, middle pane)

The real GDP of exports and imports also slowed to .4% and 4.2% in Q1 2023.

Which sector expanded? For one, gross capital formation GDP jumped to 12.2% from 3.8% in Q4 but remained lower than the scorching 17.7% in Q1 2021. Its construction segment, which bristled with a 14.2% GDP, buoyed fixed capital formation. (Figure 1, lowest window)

On the other hand, government spending GDP almost doubled from 3.3% in Q4 2022 to 6.2% in Q1 2023. It had a 3.5% GDP in Q1 2021.

The delta from expenditure GDP provides one aspect. Its share contribution is another.

Despite the sharp downshift in the YoY rate, the % share of Household GDP slipped by only a notch from 75.3% in Q4 2022 to 75.2% in Q1 2023.

On the other hand, government spending jumped from 12.7% and 14.6%. Meanwhile, bolstered mainly by construction, capital formation climbed from 21.9% to 22.9%.

So it was government spending with its 15% increase in the GDP pie which provided the cushion to generally slowing counterparts.

Q1 2023 GDP had a simple story, but was it credible?

IV. The Public Sector and Construction GDP Boom

Figure 2

Let us deal with the construction sector.

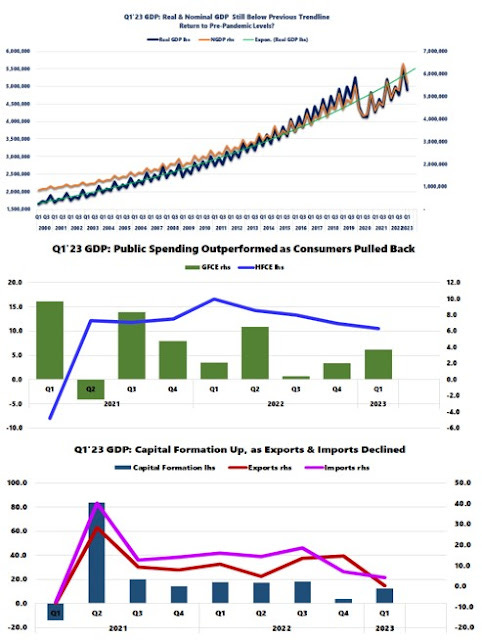

And while the private sector (financial and non-financial corporations) dominated the Q1'23 construction boom, the scale of the sector's contribution to the Public-Private Partnership (PPP) projects was unclear—though we suspect that this would be significant.

Again, because the private (26.3%) outgrew the public sector (9.6%), it grabbed the largest share (46.1%) of the (real) construction pie, while the next biggest, the public sector, shrank to 23.8%. (Figure 2, topmost pane)

Then we compare household with public spending.

The bonanza of consumer spending—financed by credit—lifted the share of the GDP in 2022.

But from 2005 to date, the general trend in the ratio between consumer and government spending has metastasized in favor of the latter.

This slo-mo transformation accelerated in 2016. But after it hit a low in Q2 2020, the ratio became rangebound. (Figure 2, second to the highest chart)

In theory, increases in public spending have been crowding out the private sector, represented by consumers, but the recent bank rescues also powered consumer spending through bank lending. A bigger growth in government activities extrapolates to lesser participation by the private sector.

In business planning, unless a crisis emerges that should force the public sector to retrench, the tactical focus should be on consumers benefiting from political dispensation, whether public or private institutions working in partnership with the government.

Meanwhile, in the present landscape, where the deteriorating financial liquidity transmits to the economy in gradation, which could prompt an aggressive fiscal response, such a scenario should likewise be unfavorable to domestic assets and the peso.

V. Q1 2023 GDP: A Peak in Consumer Spending? Bank Credit, Retail Sales and GDP in Chorus

In concurrence with the GDP, the consumer spending bonanza appears to be rolling over, which seems to dovetail with the cresting of the boiling growth rate of bank consumer loans.

Bank consumer borrowing growth has decelerated to 2.5% Q-o-Q in Q1'23 from 6.4% in Q4 2022. (Figure 2, second to the lowest diagram)

Further, revenues of the four retail firms that have reported their Q1 17-Q seem to confirm the emerging household spending slowdown. The combined sales of Puregold, Robinsons Retail, Metro Retail, and Philippine Seven grew at a slower 15.61% in Q1'23 than from the average 20.6% growth rate from Q2-Q4 2022. (Figure 2, lowest window)

Figure 3

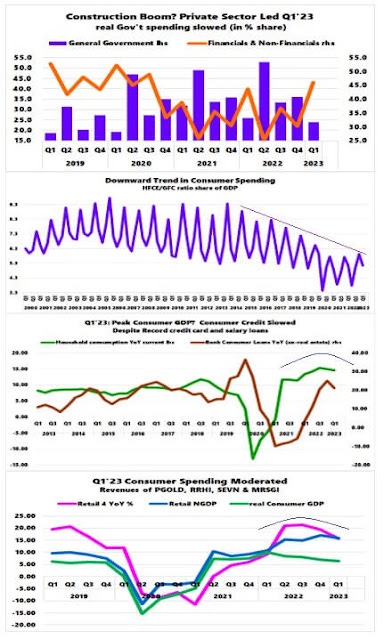

From the industry side, aside from construction, the two largest "real" GDP gainers were the transport-storage sector (14.3%) and the accommodation-food services (26.9%). Both had a minor share of the GDP of 4% and 2.2%, respectively, which have bounced steeply from their Q2 2020 nadirs. (Figure 3, topmost chart)

But retail (+7.9% 'real') wasn't the only source of the treasure trove.

Consumers also splurged on "staycation," which resulted in a windfall for hotels and other travel-related institutions (+57.1%). It's why articles on "revenge staycation" or "revenge travel" have mushroomed. (Figure 3, second to the highest window)

Food services GDP (+17.5%) naturally accompanied such extravagance. But the industry's Q1'23 growth rate of 26.9% has sharply slowed compared with the 36.5% average of the last three quarters of 2022.

So aside from retail, the slowing consumer prodigality has emerged in accommodation and food services.

That is, if bank consumer bank lending starts to stall materially, and unless the public sector takes the helm enough to fill the consumer gap, the GDP could be about to take a nasty downside.

VI. Public Spending GDP Bounce? But the Bureau of Treasury’s Data Showed Negative Public Spending Growth

Yes, sufficient data from listed firms seem to validate a "peak" in credit-funded "revenge spending" by consumers.

But the supposed rebound of public spending seems contradictory to the cross-dimensional data from other agencies.

Q1'23's public spending GDP was at 6.2% 'real' and 11.7% 'current.' But the Bureau of Treasury's data indicates a -1.06% change over the same period! Negative morphed into positive? (Figure 3, second to the lowest window)

That's right, aside from the substantial slowdown in public revenues (+4.4%), Q1'23's fiscal deficit of Php 270.9 billion signified the slowest quarterly deficit since Q1 2020!

And aside from the non-government activities, the weakening revenue could also represent the flagging receipts by the private sector from political (and affiliated) projects/undertakings.

Technically, the private sector was responsible for the upswing in construction activities. Again, such spending does not categorize/specify its allocation.

The only thing that supports the idea of a public spending boom is public debt which stood at Php 13.586 billion—a milestone in Q1'23.

As it turns out, if authorities inflated the contribution of public spending, then GDP must have also been embellished.

VII. Lower GDP from Slight Decline in NGDP and Higher Inflation, the Increasing Dominance of the Banking System, L-Shape per Capita Data

There are three more things to cover to end this review of the 1Q'23 GDP.

From last week…

In the context of the GDP, while consumer activities might have slightly lowered the nominal/current figures, high inflation rates are likely to trim its real "growth." (Prudent Investor, 2023)

Figure 4

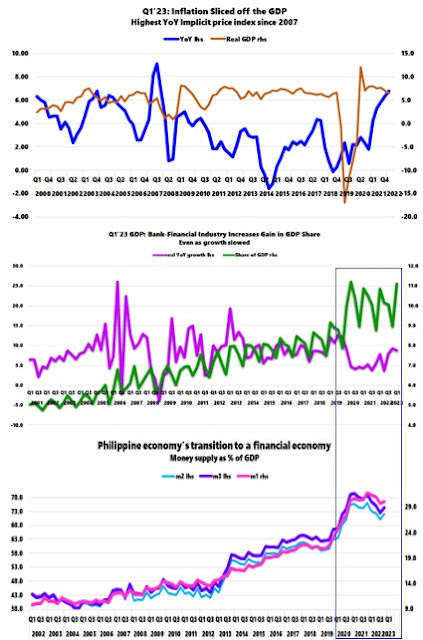

First, our observation that the NGDP would fall slightly was a bullseye!

Q1'23 NGDP dropped to 13.7% from 13.9%. The revenues of the four retail stores also confirmed this position. The Implicit Index (the equivalent of the PCE), which accounted for inflation, sliced off a substantial portion of it and thus produced a "lower" headline GDP. (Figure 4, topmost pane)

Though the 6.8% YoY change of the implicit index signified a 16-year high, it was below the CPI average of 8.3%. The data tell us the essence or the motivation for its possible understatement—to inflate the GDP.

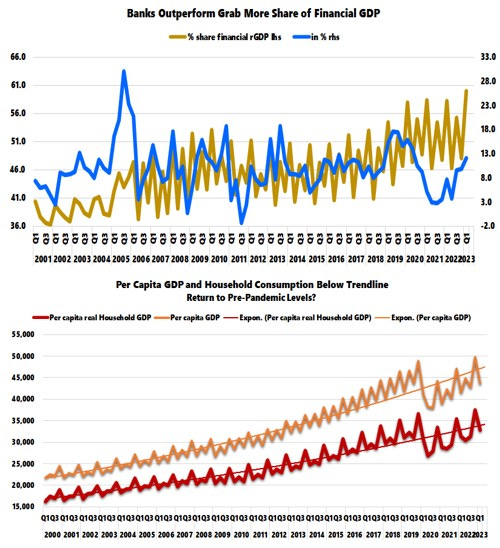

The next issue is the outperformance of the banking industry.

The financial industry registered an 8.8% 'real' GDP in Q1 2023. Although lower than the 9.3% Q4 2022, it was the second highest growth since Q1 2020.

The most intriguing part of the data wasn't its growth but its share of the GDP, which almost matched its previous record in Q2 2020! (Figure 4, middle window)

The reason for this is simple. The economy is being financialized.

The economic development paradigm pursued by authorities has been to increase dependence on credit transactions with the banking industry. As such, liquidity is all that matters to them.

And it is no coincidence that the spike in % share of the financial industry has coincided with the surge of the various measures of money supply Ms-to-GDP. (Figure 4, lowest chart)

And it doesn't stop here.

Figure 5

Banks have been crowding out or centralizing their industry as the share of non-banks, insurance & pensions, and lastly, auxiliary financial services have shrunk. Or, banks have also grown at the expense of non-bank financials. (Figure 5, upper chart)

It reveals a lot about the thrust of BSP's policies.

It is not only to financialize the economy. The architectural path of development seems to be the centralization of the financial and economic system through banks, under the direction of the BSP!

Based on this, the BSP may be about to become the most powerful institution in the Philippine political economic system! And its unelected leadership, the most influential in the political-economic domain. Again, the GDP and many of the BSP's monetary and financial data all point to this evolution.

In all this, despite the blaring chorus by the consensus about how the GDP is supposed to deliver "prosperity," the per capita and household, which reflect the GDP divided by the population, also reveal a developing L-shaped economy. (Figure 5, lower diagram)

Based on PSA's numbers, the population has risen to 112.24 million in Q1 2023.

Much of the public will be surprised by what this implies over time.

___

References

Prudent Investor, Peak 2nd Wave Headline Inflation as CORE CPI at 22-Year High! Bullish PSEi 30 from Low Rates? Philippine Yield Curve Inverts! May 08, 2023: Substack, Blogger