Robinsons Land’s 2022 Record Revenues and Income Bolstered Mainly by Consumer Credit Expansion

What is the common denominator of Robinsons Land revenues, Robinsons Retail Sales, and the CPI? Answer: Consumer Credit.

The world is full of foolish gamblers, and they will not do as well as the patient investor—Warren Buffett

Robinsons Land’s 2022 Record Revenues and Income Bolstered Mainly by Consumer Credit Expansion

___

Bank Consumer Credit Powered 2022 Robinsons Retail Sales, Robinsons Land Revenues and the CPI

"The whole is greater than the sum of its parts," the great Greek Philosopher Aristotle pointed out.

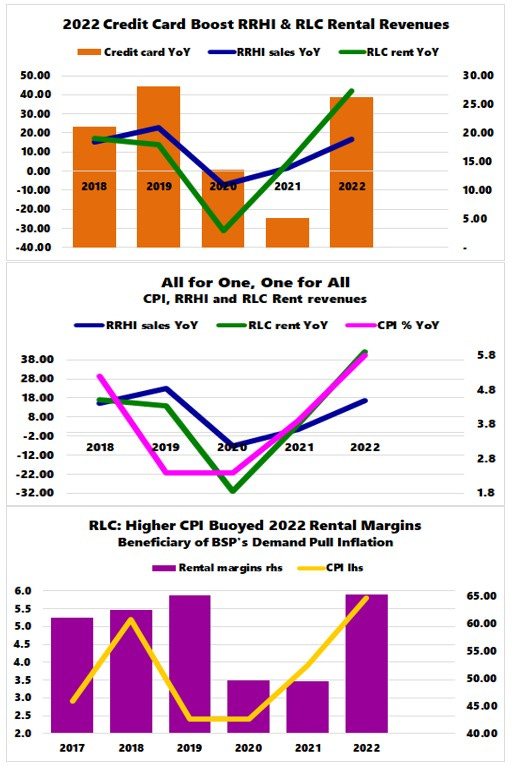

Figure 1

The 2022 annual performance of Robinsons Land [PSE: RLC], along with its sister retail chain, Robinsons Retail [PSE: RRHI], gives us a clue of the conditions of the real estate industry and consumers.

A quick glimpse of their topline reveals that the 2022 consumer borrowing boom, primarily credit cards (+26.32%), financed consumer purchases.

The rapid (+16.63%) sales growth of RRHI manifested part of this teeming consumer activity. And the bristling retail sales coaxed entrepreneurs to take up more spaces at their RLC's malls, which spiked rental revenue growth by 42%. (Figure 1, topmost chart)

Since the oscillations of all three factors—CPI, RRHI sales, and RLC rental revenues—have chimed since 2017, it implies an interrelationship—again, consumer spending fueled by intensified borrowing. (Figure 1, middle window)

Meanwhile, the rental segments' profit margins have reverberated with the CPI growth today and in the 2017-2018 episode. (Figure 1, lowest diagram)

Real Estate Sales: Bigger Share as Profit Margins Plummeted

Manila Times, March 11: ROBINSONS Land Corp. (RLC) on Friday said it had posted record growth in 2022, exceeding pre-pandemic results following robust results across all business segments. Net income attributable to the parent company rose by 21 percent to P9.75 billion compared to 2021, and the result was also 12 percent higher than in 2019, the firm said in a disclosure. The Gokongwei-led firm's consolidated revenues totaled P45.51 billion, up 25 percent from 2021 due to sales recognition of residential projects, leasing activities and mall consumption recovery.

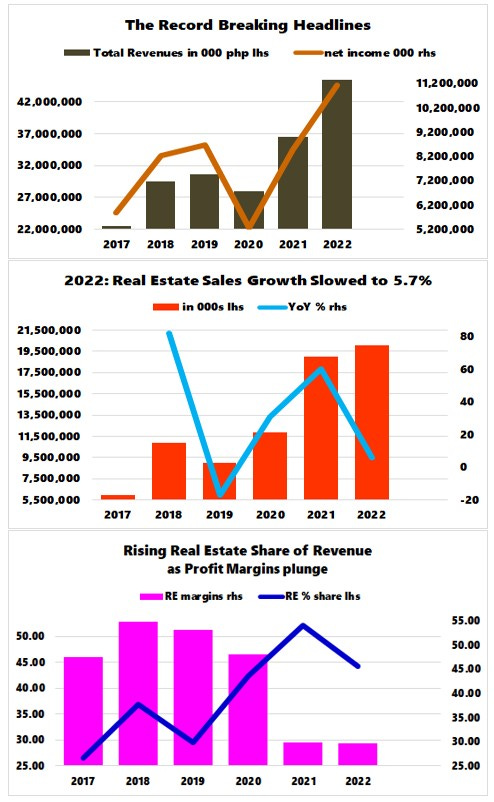

Figure 2

Nobody seems to question how the breakthrough in revenue and income ever occurs. (Figure 2, highest pane) It is all assumed as positive. The question is: are current developments sustainable?

Unlike rents, real estate revenues generated marginal growth of 5.7% in 2022 to Php 20.104 billion. Yes, in peso, it was also a record high. But the growth rate has slowed from 60.5% and 31.3% in 2021 and 2020—the pandemic era. (Figure 2, middle chart)

The sector's % share of total revenues dropped from a high of 52.05% to 44.2% in 2021 but remained substantially higher compared to the pre-pandemic era.

Having been prompted by the unmatched low-interest rate regime, many diverted savings toward real estate speculations during the pandemic.

And due to rising costs, profit margins have plunged in the last two years. That is to say, while real estate sales continue to grab a bigger segment of RLC's revenues, rising costs have compressed its margins. (Figure 2, lowest window)

Or, the RLC's record income was primarily a product of its rental business—dependent on consumer credit.

Of course, the other contributors that helped boost the topline were the spillover effect of public spending and a small piece or a minor part of it, productivity gains.

How will Robinsons Land’s Real Estate and Rental Business Fare with Higher Rates?

Interestingly, the real estate GDP and bank loans seemingly echo RLC's operations.

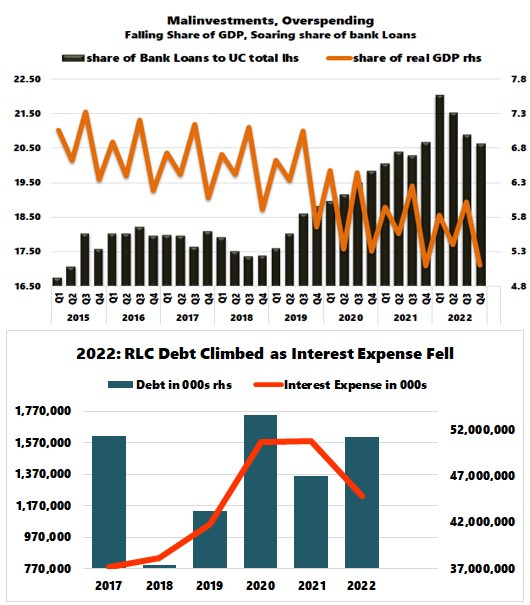

Figure 3

As it is, seen from a macro dimension, the real estate GDP pie has been in a downtrend even as the share of bank loans remains close to the pinnacle--suggesting lower economic value added as leverage mounts. (Figure 3, upper chart)

From RLC's perspective, debt grew 8.8% to Php 51.16 billion to approach its 2020 record of Php 53.6 billion even as the segment’s margins declined.

That is, the economic value added for RLC from its Real Estate business resonates with the GDP—the segment is plagued by diminishing returns.

In the meantime, despite rising rates, RLC's interest rate expense slid 22% to a 2019 level of Php 1.23 billion. (Figure 3, lower chart) The BSP's rate hikes have barely percolated into this segment.

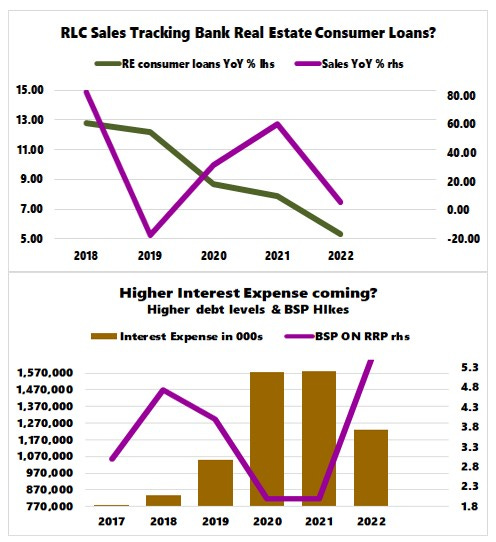

Figure 4

Also, the growth slowdown in the BSP's consumer bank real estate borrowing appears to resonate with RLC's YoY decelerating sales growth. (Figure 4, upper window)

So, aside from higher input costs, will higher BSP rates and increasing debt levels erode further the RLC's profit margins via the interest expense channel? (Figure 4, lower graph)

And will mounting debt loads and or higher rates also scrape on consumer borrowing, which should impact adversely the retail chain sales and the FOMO in the rental occupancy? Will the shopping mall and real estate industry see the same dynamic unfold?

And so, everyone's hope or bet is to see inflation and rates fall—The return of the easy money era.

And that should make 2H 2023 fascinating.