PSEi 30 3Q 2022 Performance: Confusing Inflation for Growth, The Slowing Growth Momentum of the Real Estate Sector

Have there been a revenue and earnings boom in the 3Q & 9M for the elite members of the PSEi 30? Or have the headline growth signified the "base effect" and the "money illusion?"

The second factor contributing to speculative euphoria and programmed collapse is the specious association of money and intelligence. This view is then reinforced by the air of confidence and self-approval that is commonly assumed by the affluent—John Kenneth Galbraith

In this issue

PSEi 30 3Q 2022 Performance: Confusing Inflation for Growth, The Slowing Growth Momentum of the Real Estate Sector

I. 3Q-9m Performance: Most of GDP Dynamics Seen in PSEi 30 Financial Conditions

II. Liquidity Management: PSEi 30 Amassed RECORD Debt as Headline Growth Represented Base Effects!

III. Sectoral Performance and The Slowing Growth Momentum of the Real Estate Sector

IV. PSEi 30 Member Performance: Confusing Inflation for Growth

PSEi 30 3Q 2022 Performance: Confusing Inflation for Growth, The Slowing Growth Momentum of the Real Estate Sector

Along with the GDP, the animated announcements of the 3Q financial performances of publicly listed firms must have rationalized the recent bounce in the stock market.

But based on the results of the elite members of the benchmark PSEi, the primary drivers of activities during the period were debt and inflation.

I. 3Q-9m Performance: Most of GDP Dynamics Seen in PSEi 30 Financial Conditions

From our humble analysis, the principal factors that fueled 3Q GDP were the following:

1) the base effect,

2) the understatement of inflation,

3) "excess" demand from record consumer credit,

4) the "lagged" effect of 2020 liquidity injections,

4) the belated impact of election spending, and

5) record public spending.

The financial results of the publicly listed firms of the elite 30 appear to have resonated with propositions from the GDP.

As always, bottom and top-line growth serve as the centers of the public discourse on the financial markets.

Aside from ignoring other factors, the statistics frequently cited hardly differentiate between the nuances of the comparative operating periods. For instance, there have been few attributions to the changes in the political environment that led to the present magnified financial gains.

Naturally, gains were substantial since there had been more activities from the present "reopening" compared with last year's restricted social mobility due to the pandemic policies. The overlooked variances constituted the "base effect."

II. Liquidity Management: PSEi 30 Amassed RECORD Debt as Headline Growth Represented Base Effects!

But the reopening did not operate in a vacuum. Social activities required financing.

Figure 1

Aside from the lagged effects of the unprecedented liquidity injections and the election spending, the record consumer credit and demand from the unmatched deficit spending magnified revenue growth.

As it turned out, revenue growth represented the "money illusion" from the combination of these factors.

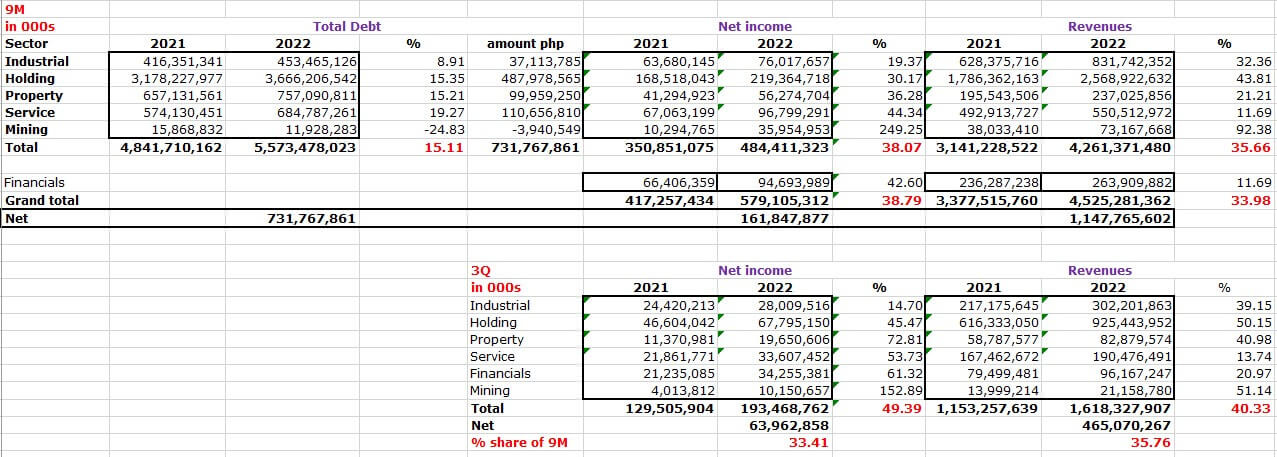

Though gross revenues of the elite 30 expanded by 34% in 9M YoY, net revenues soared by 272%. (Figure 1 top window)

And while the 9M aggregate income of the benchmark PSEi bulged by 38.8% YoY, its (net) net income of Php 161.9 billion was only 14% higher than last year's Php 142 billion. (Figure 1, middle pane)

But here's the kicker. Despite growing from a high base, the published aggregate debt grew by 15% YoY in 9m of 2022. However, the net debt increase amounting to Php 731.8 billion from the 27 non-bank members was more than double or 131.3% higher than last year! (Figure 1, lowest pane)

The irony of this unprecedented 9-month net debt accumulation was that it occurred in the face of rising rates!

So while financial statistics projected "growth" designed to assuage the public and salivate the appetite of gamblers, many publicly listed companies, not limited to the PSEi members, were in a mad dash to raise liquidity!

Incredible.

III. Sectoral Performance and The Slowing Growth Momentum of the Real Estate Sector

Figure 2

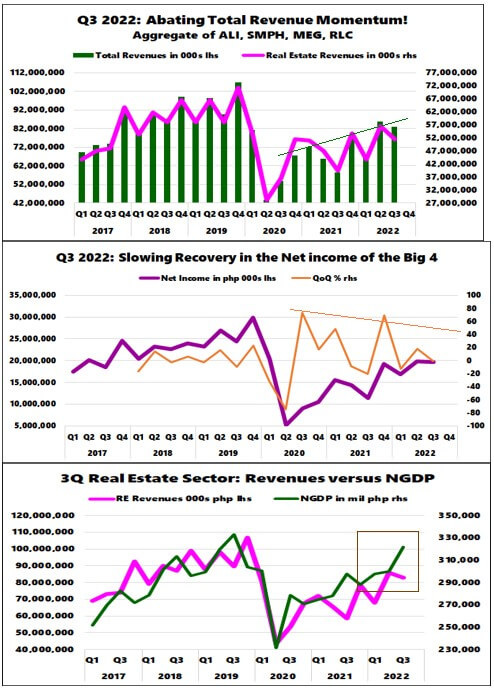

By sector, in the 3Q, Semirara, the sole representative of mines in the PSEi 30, generated the most % returns in revenues (51.1%) and net income (+152.9%) from a boom in coal prices.

Meanwhile, the property sector, up by 72.8% YoY growth, placed second in net income growth.

The holding firm sector, which grew by 50.2%, ranked second in revenue growth.

Figure 3

Many have pinned their hopes on a strong recovery of the property sector.

But to enlighten our readers from statistical mirages, the growth momentum of the cumulative nominal performance of the real estate index, represented by the nation's four largest firms (on a quarter-on-quarter basis), appears to have been decelerating. (Figure 3)

Yes, the real estate sector jumped from last year. That was due to the base effect. But despite the rising prices, nominal performance, measured by quarterly changes, has been diminishing.

Interestingly, the nominal GDP and revenues of the biggest four real estate firms appear to be diverging.

Nonetheless, as further evidence of inflation, 3Q PSEi 30 revenues comprised 35% of the 9-month total. Or, as the CPI went up, so did its share of revenues.

Year to date (9 months), aside from Semirara, the service sector generated the second-highest growth with 44.34%. The holding firm sector snared the next level of growth rate with 43.81%.

The holding firm sector also has the largest share (67%) of non-financial net debt growth.

IV. PSEi 30 Member Performance: Confusing Inflation for Growth

Figure 4

By component members, in the 3Q, the top 3 revenue gainers pesos were San Miguel, SM Investments, and Ayala energy firm ACEN Corporation.

Meanwhile, SM, JG Summit, and Aboitiz Equity registered the highest net income in pesos.

Year to date, San Miguel, SM, and Aboitiz Equity led revenue growth in pesos.

Semirara, SM, and LTG topped the net income expansion in pesos.

Finally, San Miguel, SM, and SMPH added the most debt in the 9-months of 2022.

Interestingly, San Miguel, aside from amassing a stunning Php 295 billion in debt YoY, accounted for a 40% share of the PSEi 30 YTD revenues!

Furthermore, SMC subsidiaries Petron and Global Power comprised a remarkable 89% of the firm's net revenues! (Please check out this quarter’s San Miguel’s analyst briefing)

The thing is, the substantial growth in energy and energy-related revenues had been about inflation. Growth of retail sales also partly signified inflation.

Like the import data, a considerable chunk of the revenue gains of the PSEi 30 represented higher prices or the "money illusion," which resonated with the nominal GDP.

And evidently, consumers (retail and industrial) absorbed the pass-through pricing of these firms primarily through debt financing.

And in our humble opinion, many member firms may have overstated profits.

For this reason, the historic amassment of debt became the focal point of balance sheet liquidity management of PSEi 30 firms.

As it is, the consensus misconstrues credit-fueled price inflation as growth!