PLDT’s "Budget Overrun" Issue in the Eyes of Historian Charles Kindleberger

Does PLDT's "budget overrun" issue represent a sign of Charles Kindleberger's transitional process to the "panic stage?"

Crashes and panics are often precipitated by the revelation of some misfeasance, malfeasance or malversation (the corruption of officials) that occurred during the mania. The inference from the historical record is that swindles are a response to the greedy appetite for wealth stimulated by the boom; the Smiths want to keep up with the Joneses and some Smiths engage in fraudulent behavior. As the monetary system gets stretched, institutions lose liquidity and unsuccessful swindles are about to be revealed, the temptation to take the money and run becomes virtually irresistible—Charles P. Kindleberger

PLDT’s "Budget Overrun" Issue in the Eyes of Historian Charles Kindleberger

Using extended quotes from the media, the following is a chronicle on the surfacing controversies surrounding PLDT, one of the Philippines’ leading telco companies. (all bold mine)

I. The Excess Capital Spending

First, the telco company announced that it embarked on an internal investigation into a so-called "budget overrun."

Inquirer.net, December 17, 2022: Tycoon Manuel Pangilinan, who chairs the country’s largest telecommunications firm, was initially apprised of the preliminary discovery of as much as P130 billion in financial anomalies in PLDT Inc. two months ago, before this number was trimmed to the P48 billion the telco announced on Friday.

Businessworld/Bloomberg, December 19, 2022: The budget overrun is almost equivalent to PLDT’s combined 2020 and 2021 net income. It’s also more than twice the P21.46 billion of cash and cash equivalents that PLDT had at the end of last quarter. While PLDT hasn’t given details, Mr. Pangilinan said in a Philippine Daily Inquirer report that as much as P130 billion in undocumented purchases were made from 2019 through 2022 and an audit lowered the “questionable deals” to P48 billion.

Next, internal financial forensics, which the company embarked on, provided some details.

Inquirer.net, December 17, 2022: The announcement follows weeks of rumors of an internal probe at the country’s biggest integrated telecommunications provider over supposed financial anomalies. Complaints were also raised by some of the company’s suppliers during the probe, sources told the Inquirer. PLDT stressed in the disclosure that it had so far found no fraudulent transactions, procurement anomalies, or loss of assets arising from the capital spending overruns. It was also in negotiations with suppliers and vendors to cut the unexpected spending increase. “Our vendors continue to be committed to their partnership with PLDT and have expressed flexibility with our commercial requests involving reduction of outstanding work,” PLDT said. The overruns covered capital spending (capex) over four years from 2019 through 2022, the telco giant said. “In the face of the pandemic, and especially at its height, PLDT and Smart continued its capex spend, resulting in enhanced connectivity for our people, and better customer experience,” it said. “While these substantial capex investments were key to meeting PLDT’s goals, they came at a price—capex investments for these four years aggregated to P379 billion, including an estimated budget overrun of no more than P48 billion,” PLDT said. PLDT said the estimate was based on an ongoing internal forensics mandated by the board and its audit committee and discussions with principal vendors. In a disclosure on Friday, the telco giant led by Manuel V. Pangilinan said the excess amount represented 12.7 percent of the total P379-billion capex spending for the period. “PLDT is undertaking a management reorganization process and has initiated improvements on its processes and systems to address weaknesses that allowed such budget overruns to occur,” the listed company said. The capex was allocated to multi-year projects including LTE and 5G rollout, Fiber-to-the-home investments, fiber, submarine cable expansion and tower upgrades, PLDT noted. The major telecommunications player said its major revenue streams have remained “healthy and robust” despite the billions-worth of additional expenses. The wireless, home and enterprise businesses were shielded from the capex overrun, PLDT assured.

Then, because of such overspending, the telco declared a cut in future CAPEX, and it would reorganize the management and improve its systems.

Businessworld, December 23, 2022: PLDT INC. on Thursday said it will cut its capital expenditure budget starting next year, as it grapples with the fallout from the P48-billion budget overrun that sparked a sell-off and a probe by regulators… The PLDT chairman said the company’s ongoing review has uncovered “no fraud, no anomalies, no evidence of overpricing, and no unrecorded transactions in relation to the overrun.” PLDT expects to exceed its P85-billion capex guidance for 2022, as the company hopes to keep its projects, including the hyperscale data center in Sta. Rosa, Laguna, on track.

The firm also emphasized that "no fraud" was involved in the four years of unauthorized capital overspending.

They also publicly underscored that the excessive CAPEX allocation had been on "necessary network equipment to boost connectivity." Or it justified the expenditures.

CNN Philippines, December 22, 2022: "PLDT’s business overall remains healthy and robust even as it continues to address its elevated capex spend and undergoes a comprehensive process review," the company said in a disclosure. Pangilinan reiterated that the company’s investigation of the budget overrun that covered four years found no anomalies or unrecorded deals. He said "bulk" of the controversial amount involved purchasing necessary network equipment to boost connectivity, particularly PLDT's 5G push for mobile and fiber rollout. "There will be no write-off of these assets," he said. PLDT President and CEO Alfredo S. Panlilio also said there was a "confluence of factors," which includes the following: - underinvestment in capex - threats of then President Rodrigo Duterte against incumbents - heightened competition in the market following DITO Telecommunity's entry and Converge's strengthened position in the fiber space - the COVID-19 pandemic and continual lockdowns under the Duterte administration pushing up demands for fiber connectivity at homes "However, to the extent of the capex ordered, we plan to reduce fresh capex starting in 2023. Thereafter, we expect capex to reduce steadily. 2023 will be a year of consolidation as we continue to strengthen and grow the business. We strive to be better," said Panlilio.

The firm likewise enumerated the possible "confluence of factors" behind such a critical financial lapse.

II. Why the Ruckus over the Capex? PSE Investigates "PLDT" Pre-Closing Dump?

Here is the thing.

Whether through replacement, maintenance, upgrades, or expansion, the primary role of capital expenditures is to magnify profitability through enhanced productivity. In this case, the "bulk" of the CAPEX involved network equipment.

And the controversy can't solely be about accounting metrics, such as depreciation. The simple reason is that improvements through lower costs in the other areas of operations should offset the former over time.

Besides, how and why would such a seismic lapse occur in the face of the firm's armies of internal and external managers, accountants, financial analysts, auditors, and lawyers, aside from the officers of other relevant departments?

So, if there have been "no anomaly or fraudulent transactions," and if the allotments of the CAPEX meet business objectives, then why the ruckus over it? And why the violent reactions to its share prices in the stock market?

Nevertheless, this event raises credibility concerns about the company's Financial Statements.

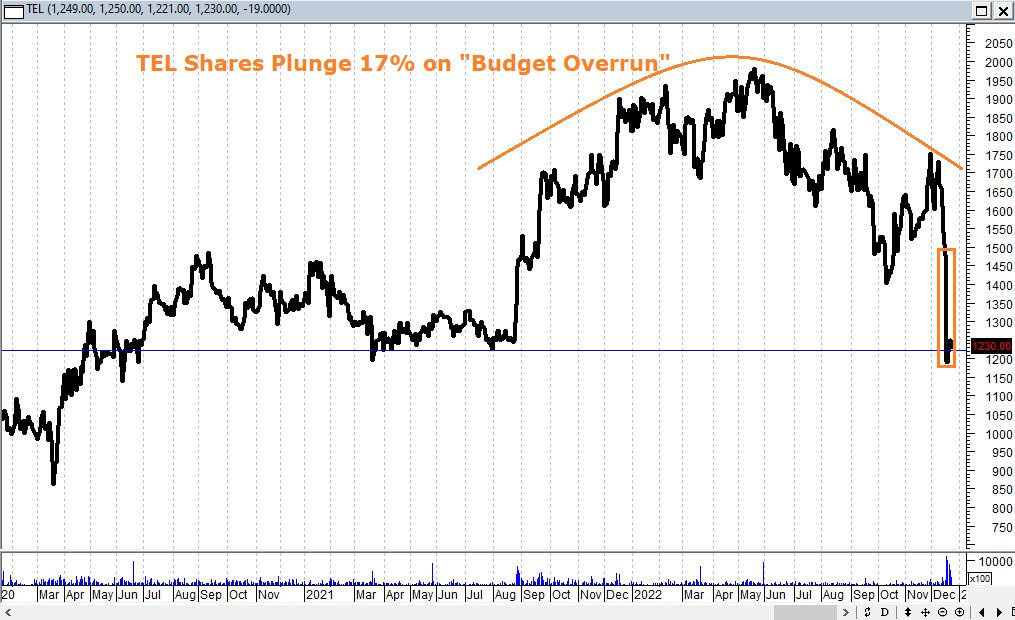

In any case, authorities have launched investigations that followed the share price meltdown of the telco firm. PLDT shares plunged 17% on its announcement.

Though PLDT share prices have rallied from the March 2020 lows to a May 2022 peak, a bearish "rounding top" appears to hound its chart even before the revelation of the "budget overrun."

Businessworld, December 20, 2022: According to the Securities and Exchange Commission (SEC), it is closely monitoring issues that have arisen from the announcement of PLDT regarding the budget overrun as well “selloff in shares” prior to the disclosure on Friday last week. These are “areas of concern for the commission being the regulator of the securities market and the champion of investor protection in the country,” the SEC said in a statement on Monday, “In this light, the SEC has immediately commenced an inquiry into the matter,” the regulator said. At the same time, the SEC said that PLDT needs to clarify its disclosures to the commission and The Philippine Stock Exchange, Inc. (PSE) in relation to statements attributed by the media to the company and its officers, especially with regard to the nature of the P48-billion expenditure. “The SEC has likewise directed PSE and Capital Markets Integrity Corp. (CMIC) to submit initial reports on their investigation into the trading activities that have resulted in the sudden and sharp decline in the share prices of PLDT before the official disclosure of the ‘budget overruns,’ among others,” the regulator noted. CMIC serves as the independent audit, surveillance and compliance arm of PSE.

Interestingly, the PSE raised the issue of the pre-closing dump of PLDT shares. (!)

Inquirer.net, December 18, 2022: The Philippine Stock Exchange will investigate the trading activity on shares of PLDT Inc. — the oldest blue chip stock on the bourse — after regulators noticed heavy selling minutes before the market closed last Friday and about an hour before a P48-billion financial anomaly within the telecommunications firm was officially disclosed to the investing public…Monzon was referring to the 4.5-percent decline in PLDT’s share price in the last few minutes of trading last Friday. That selloff brought PLDT’s price down from P1,548 to P1,478 just four minutes later, wiping out more than P18 billion in market capitalization during that short span of time.

To repeat: "referring to the 4.5-percent decline in PLDT’s share price in the last few minutes of trading."

But pre-closing pumps and dumps have become a prominent or even commonplace feature of the domestic equity benchmark, the PSEi 30! The activities of this benchmark translate to excessive volatilities in the share prices of several market cap heavyweights at the transition to the closing bell: The price float from pre-closing to the runoff period.

So how will this stand as a sound basis for inquiry on unscrupulous trading practices?

III. Kindleberger’s "Panic" Stage, The Erosion of Confidence and the Cockroach Theory

And it's not just casuistic trading. It is about the entire financial system.

Here is an excerpt from this author's 2017 blog.

Instead, speculative mania has embedded a sense of entitlement that free lunches are the path to prosperity. And so, the pivot to such desperate unscrupulous measures.

If institutions could "game" the markets with impunity, could their financial statements have been grounded on the same outlook/mentality? (Prudent Investor, 2017)

The late historian Charles P. Kindleberger wrote that unscrupulous financial activities tend to grow with the propensity to speculate (mania) and get exposed during signs of mounting economic or financial stress (panic).

There are many forms of financial felony. In addition to stealing, misrepresentation, and lying, other dubious practices include diversion of funds from the stated use to another, paying dividends out of capital or with borrowed funds, dealing in company stock on inside knowledge, selling securities without full disclosure of new knowledge, using company funds for noncompetitive purchases from or loans to insider interests, taking orders but not executing them, altering the company’s books.

…

The revelation of swindles, frauds, and defalcation, and the arrests and punishment of those who violate trust are important signals that economic euphoria has been overdone and that there will be significant social consequences (Kindleberger & Aliber, 2005)

That’s not all.

In a November 2020 tweet, economic professor and confidence-driven decision-making researcher Peter Atwater theorized the inverse relationship between confidence and scrutiny.

Scrutiny and confidence are inversely related. At peaks in confidence no one sees any reason to check anything. There is no scrutiny. None.

In another tweet, Mr. Atwater further observed that the loss in financial trust signifies a product of falling confidence.

Auditors don't find fraud. Falling confidence reveals them as heightened self-interest, greater scrutiny and focus shine a light on missteps taken amid eras of overconfidence.

Furthermore, aside from fear and greed, confidence and its erosion, another concept compliment this narrative: the cockroach theory.

According to businessprofessor.com, the cockroach theory means that "a piece of bad news in the market indicates that there is much more bad news." The underlying premise: "the appearance of one (cockroach) in an area signals the presence of many others. The cockroach theory posits that the announcement of one negative news means many more negative events will occur to a company or an industry."

To emphasize. This post is not about the involvement of legal irregularities in PLDT's multi-billion "budget overrun." That's the role of the credit rating agencies and regulators, who seemed asleep on the wheels.

Instead, the PLDT episode falls into one of the inflection phases of Mr. Kindleberger's cycle of "Manias, Panics, and Crashes."

The vehement stock market reaction to the CAPEX controversy infers a process of falling confidence and eroding trust.

Aside from the recent default risk from Udenna, the fuss over PLDT's CAPEX could be a "canary in the coal mine" or the first among the many "cockroaches."

It likely represents a pivotal sign of reversal from the era of speculative mania, financial excesses, operational and legal complacency, and market overconfidence.

Instead of a renascence, it signifies a persistent deterioration of the financial system and the economy.

As a side note, do you know that the so-called exorbitant spending of Php 48 billion represents 72.25% of Megaworld's 'full market capitalization' as of December 23rd? As of this date, MEG has the smallest market cap, which should show the scale of "overspending." Also, Php 48 represents about 18% of PLDT's full market cap.

IV. The Capex Furor as Justification for More Debt?

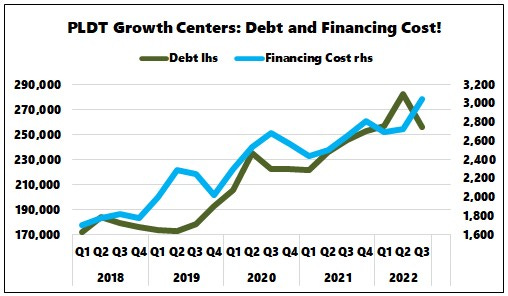

Yet, no one seems to be asking the right question. How has the capital "overspending" of PLDT been financed?

Edge PSE December 23, 2022: "We confirm the statement of PLDT Inc.’s President and Chief Executive Officer, Mr. Alfredo S. Panlilio (“Mr. Panlilio”), that the Company may incur additional debt in the short term. His statement, however, does not include the impact on the Company’s reported income. The plan to borrow P35-45 billion in the next two years is for general corporate purposes including, but not limited to, payment of CAPEX and dividends."

Could the furor over "budget overrun" have been about justifying to the public and its creditors its desire to imbue more debt?

Aside from its mounting debt, will the telco firm raise cash to cover unwanted expenditures by selling more of its productive assets? This year, PLDT sold and leased back more than half, or 6,500, of its 12,000 cell towers for about Php 86 billion, according to the Inquirer.

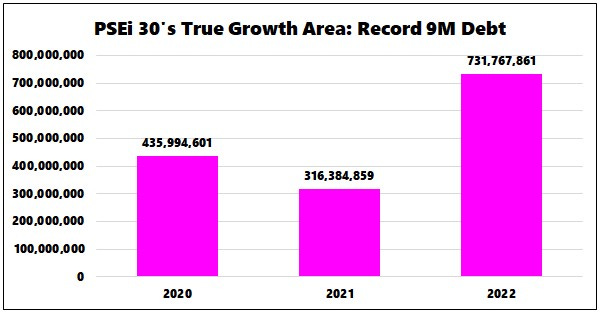

Of course, PLDT represents a component of the PSEi 30, where the benchmark's only growth area has been debt.

The current conditions suggest heightened systemic fragility from financial excesses, malinvestments, excessive complacency, trust, and confidence issues.

____

Prudent Investor May 14th: The Biggest Ever Rescue of the PSYEi 30! May 17,2017

Kindleberger, Charles P. and Aliber, Robert Z. Manias, Panics, and Crashes A History of Financial Crises, p. 195 and 202, Fifth Edition, 2005, Wiley & Sons, delong.typepad.com