Philippine Core CPI Forged a New 22-year High! Signs of Peak 2nd Wave Inflation: Pullback in Bank Lending and BSP Injections

Philippine headline CPI barely changed in February, while Core CPI sprinted to a 22-year high! But has this inflation cycle peaked? Clues from banks and the BSP suggest it has.

So now we see, at last, that the business cycle is brought about, not by any mysterious failings of the free market economy, but quite the opposite: By systematic intervention by government in the market process. Government intervention brings about bank expansion and inflation, and, when the inflation comes to an end, the subsequent depression-adjustment comes into play.—Murray N. Rothbard

In this issue

Philippine Core CPI Forged a New 22-year High! Signs of Peak 2nd Wave Inflation: Pullback in Bank Lending and BSP Injections

I. While the February CPI Slipped, Core Inflation Forged a New 22-year High! The Futility of the Inflation Task Force

II. Rate Hikes Barely a Hurdle on the Insatiable Desire to Expand Deficit Spending

III. Defying Rate Hikes: Credit Card and Salary Loan Growth Sizzled Fueling Inflation as Bank Savings Stagnates

IV. Credit Card Debt Fueled Segments of Core Inflation; The Invisible Redistribution

V. Peak Second Inflation Wave? The Law of Demand: Has the BSP’s Rate Hikes Started to Impact Quantity of Loans?

Core CPI Forged a New 22-year High! Signs of Peak Inflation 2nd Wave: Pullback in Bank Lending and BSP Injections

____

I. While the February CPI Slipped, Core Inflation Forged a New 22-year High! The Futility of the Inflation Task Force

The consensus appears to be celebrating the unexpected "easing" or "moderation" of the CPI.

GMA News, March 7: Inflation or the rate of increase in the prices of goods and services moderately slowed down in February, thanks to the slower movement in transportation and fuel costs, the Philippine Statistics Authority (PSA) reported on Tuesday. The headline inflation or the rate of increase in the prices of products and services in the country decelerated to a rate of 8.6% in February 2023. Year-to-date inflation print stood at 8.6%, according to the PSA chief.

However, insisting that this remains a supply-side phenomenon, authorities pushed to establish a "task force" to tackle inflation.

Inquirer.net, March 8: In a brief statement, Presidential Communications Secretary Cheloy Velicaria-Garafil said Mr. Marcos approved the proposals “in general.” Diokno said that among the measures was the establishment of an interagency committee to monitor prices, agricultural production, and food supply to help the government decide when is the right time to import. Secretary Arsenio Balisacan of the National Economic and Development Authority (Neda) noted that the creation of the high-level committee was urgent.

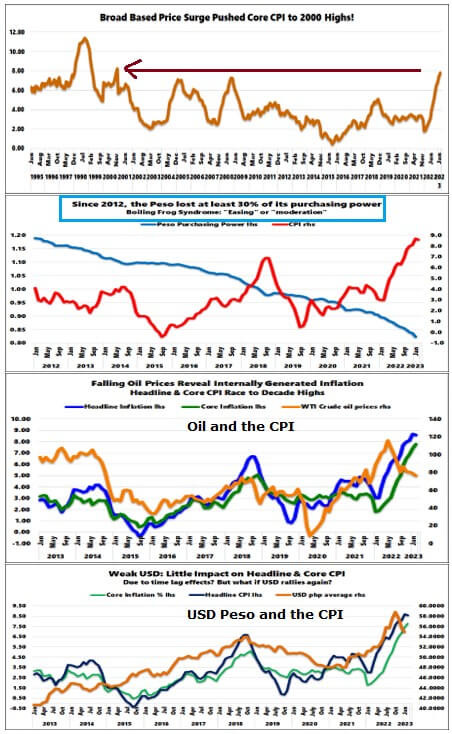

Figure 1

But while the 8.6% February CPI was lower than consensus expectations, it was slightly down from the 8.7% in January.

Most importantly, while addressing food inflation signified the objective of the proposed creation of the "task force," the February non-food and non-energy 7.8% CORE CPI rocketed to a new 22-year high! (Figure 1, topmost chart)

It means that inflation has diffused beyond the corridors of food and energy!

Further, though the CPI rate may decline, it doesn't mean inflation is falling. It pertains to the continuing erosion of the purchasing power of the peso but at a slower pace.

From January 2012 through January 2023, the peso has shed 31% of its purchasing power. (Figure 1, second to the highest window)

Hence, January 2023 peso, assuming its proximity to reality, is worth 69 cents of the 2012 peso. Analogous to the boiling frog syndrome, the peso is gradually being burned at the people's expense.

And this is hardly good news for the average citizen. It is good news for the government and the elite borrowers.

Nonetheless, have you noticed that "imported inflation" has vanished from the script of the consensus?

Why so?

Because the prices of the "external" factors—oil and USD Php—have significantly declined! Yet the headline and the core CPI remained stubbornly elevated. (Figure 1, second to the lowest and lowest charts)

This omission reveals the constant shifting of goalposts by authorities.

That’s not all. Let us not forget that there are distortions in the calculation of statistical inflation, which include price controls, base rates used, biases in conducting surveys, and others. The context here translates to the understatement of the CPI.

Yet, while remaining reticent on demand, authorities have been implicitly signaling to the public that "greed" by unspecified private economic agents has signified the source of inflation. That is, the government is "good," while the private sector is "bad."

Hence, it is their duty to instill order in their constituencies through mandates and controls.

Sad to see that even from the supply side, officials with economic backgrounds fail to comprehend that competition on itself should contain "greed."

Bluntly, the task force will be assigned to implement centralized controls of the national supply chain.

The thing is, authorities assume that they possess what the great Friedrich von Hayek called "knowledge of the particular circumstances of time and place" in real-time covering the spectrum of all required food supplies to meet dynamic demand.

But they admit to reactionary impulses when stating that the intent of monitoring is "to help the government decide when is the right time to import."

So prices would still escalate before they respond, which also extrapolates to a time-consuming process. And by the time they act, price pressures from feedback loops might have spread to the other sectors.

The recent experience highlights this phenomenon.

Yet, their assumptions have another critical flaw. It omits the future—changing individual preferences, economic conditions, exchange rates, international food prices, availability of supplies, weather, and agricultural variable, among many other factors.

To ram this knowledge problem point home, their inability to know the shifting preferences and values of individuals, which shapes economic calculation that drives exchanges, highlights the vulnerability of central planners to policy errors.

Or whatever centralized task they are duty-bound to do is destined for failure.

The fact that they have kept the public in the dark about the contributions of demand tells us that their proposed policies intend to show the voting public that they are "doing something."

It stands to reason that the clamor for creating a task force to contain inflation is about public signaling to gain popular political support.

In any case, our role is to bridge this analytical void.

II. Rate Hikes Barely a Hurdle on the Insatiable Desire to Expand Deficit Spending

Last week, we elaborated on how deficit spending fuels inflation. (Prudent Investor, 2023)

This week we are told of the planned ambitious deficit spending programs for 2023, including the Php 9 trillion in infrastructure spending projects.

And then there is the Php 1,000 inflation subsidy or cash transfer program for the 9.3 million belonging to the "poorest of the poor."

Basically, such projects signify "throwing money" at different targeted political groups, which are popularly rationalized as meant "for the greater good." But this translates to expanding the deficit spending—all dependent on a cheap money regime.

Additionally, authorities appear to be exhausting their balance sheet capacity even when the GDP remains "hot." What happens when recessionary forces become apparent?

Would authorities be forced to amplify their fiscal "stabilizers" even at the risk of blowing up street inflation?

Will the age of inflation become entrenched through such actions?

III. Defying Rate Hikes: Credit Card and Salary Loan Growth Sizzled Fueling Inflation as Bank Savings Stagnates

But there is more.

Aside from deficit spending, increases in the money supply from bank credit expansion are likewise inflationary.

Naturally, when increases in money supply through bank credit expansion—are unsupported by increases in production—this brings about economic imbalances. Yes, inflation.

Proof?

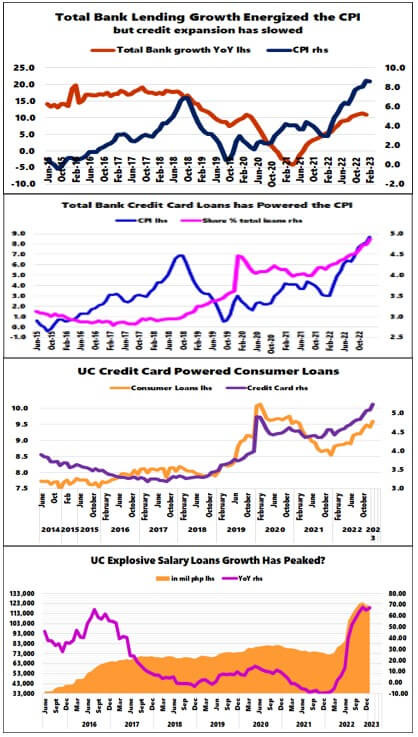

Figure 2

The rate of change in the lending of all banks (Universal-Commercial, Thrift, and Rural/Cooperative) have been congruent with the gyrations of the CPI. (Figure 2, highest window)

Total bank lending grew by 10.9% in January, down slightly from 11.3% a month ago. In contrast, there was a sharp deceleration of bank lending of the Universal-Commercial banks (UC), which logged in at 10.21% in January from 13.54% in December.

In short, the bank lending of the thrift and rural banks carried the torch of inflation last January. And part of this borrow-spend phenomenon may have spilled over to February.

Interestingly, the % share of the credit card portfolio of the total banking system (UC, thrift and rural/cooperatives) stormed to a record high of 4.9% in January! (Figure 2, second to the highest chart)

This record upsurge also reflected the activities of the dominant Universal and Commercial banks, which pushed the % share of the credit cards to the aggregate UC lending to a milestone high of 5.2%! (Figure 2, second to the lowest pane)

Partly due to the interest rate cap and mainly because of the reduction in purchasing power of the peso, credit card expansion has transformed into a potent driver of price inflation.

Credit cards have principally powered consumer lending—the latter's share of bank lending has been soaring too!

The explosive growth of the salary loan portfolio of the UC banks, which soared by 67.05% in January, the second highest rate after November 2022, also supported credit card growth and general household loans (excluding real estate). (Figure 2, lowest window)

Figure 3

Incorporating household real estate loans, the consumer loans pie relative to the total loan portfolio swelled to 19.25% in Q4 2022, the third highest since Q3 2020! (Figure 3, topmost chart)

That’s not all.

Fundamentally, the structural transformation in the distribution of UC bank lending supports the adage "too much money chasing too few goods."

The rapidly rising share of consumer loans to the aggregate UC bank lending relative to industry loans indicates more credit-financed consumer spending at the expense of supply-side financing. (Figure 3 middle window)

Or, banks have been lending more to the consumers (demand) while industry loans (supply) have underwhelmed.

So with more money funding consumption than production (ceteris paribus), wouldn't that lead to inflation?

As a caveat, yes, it is true that consumer loans (ex-real estate) account for only about 5% of the overall lending activities—it is easy to be misled by simplistic analysis of statistics—but indebtedness covers about half of the households primarily through informal channels, according to the Financial Inclusion data of the BSP.

So, while savings have financed part of it, we can only infer that the principal source of informal credit transactions has been (formal) bank credit expansion.

Besides, the savings account of the banking system has been stagnating; it posted a paltry .1% growth last January, its fourth month out of the last five of non-growth! (Figure 3, lowest chart)

While some may be transferring their peso savings into Time Deposits or FX deposits, peso savings represent about 38% of bank deposit liabilities and 28.5% of total liabilities last January.

So the declining growth of savings has likely signified a drawdown. The public has been consuming their corn seeds.

Or, the public has been drawing from their savings account to finance the plunging purchasing power of the peso. It also exposes the trend of diminishing productivity underpinning the economy.

Given that savings are finite, what happens when the sustained drawing results in a depletion?

"Resilient" consumers? "Sound macro," really?

IV. Credit Card Debt Fueled Segments of Core Inflation; The Invisible Redistribution

It is interesting to observe in the February CPI data that the whizzing prices of core segments—housing and utilities, furnishing and household equipment, and personal care and miscellaneous goods—have been in tandem with credit card growth.

So, have those with access to credit cards been driving up the prices of these non-core items?

And as primary spenders of newly infused money, these buyers benefited from prices at the time of their purchases, while subsequent buyers pay at higher prices. This process effectively transfers purchasing power to credit card buyers. And proof of redistributing wealth from the poor to the rich…

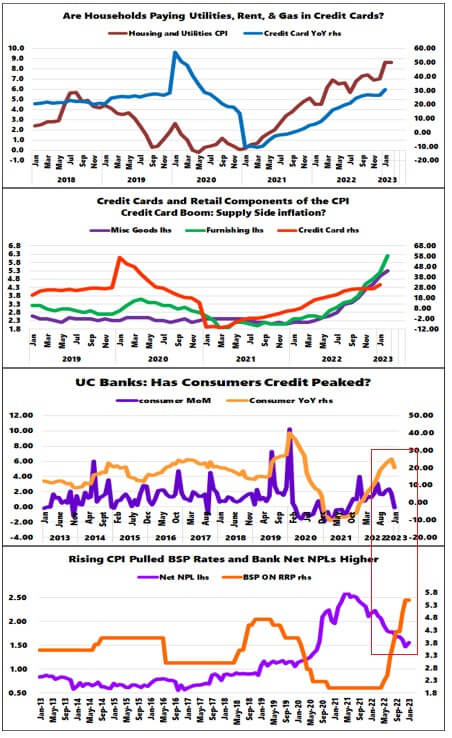

Figure 4

Housing and utilities, furnishing and household equipment, and personal care and miscellaneous goods posted a CPI of 8.6%, 6.2%, and 5.3% last February. (Figure 4, topmost and second to the highest windows)

Utilities and furnishing pivoted higher along with the inflection and recovery of credit card growth from deflation in Q1 2021.

No wonder sales of a listed member of the PSEi 30 member boomed as credit card growth and the CPI spiked in 2022. (Prudent Investor, 2023)

It showcases the invisible resource transfer explicitly described by JM Keynes. (bold mine)

By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security but [also] at confidence in the equity of the existing distribution of wealth. (Keynes, 1919)

Unfortunately, to quote the late American economist Herb Stein, "If something cannot go on forever, it will stop."

V. Peak Second Inflation Wave? The Law of Demand: Has the BSP’s Rate Hikes Started to Impact Quantity of Loans?

The law of demand tells us that as the price of credit increases, its effect on demand for credit will be a reduction in quantity.

But the impact of the recent BSP monetary policies will have to blend in with other forms of existing interventions, such as liquidity injections, FX market interventions, and various relief measures and more.

It means that rate hikes under this setting will have a time-inconsistency effect—adjustments over the conflicting new and incumbent policies could materialize over different time periods.

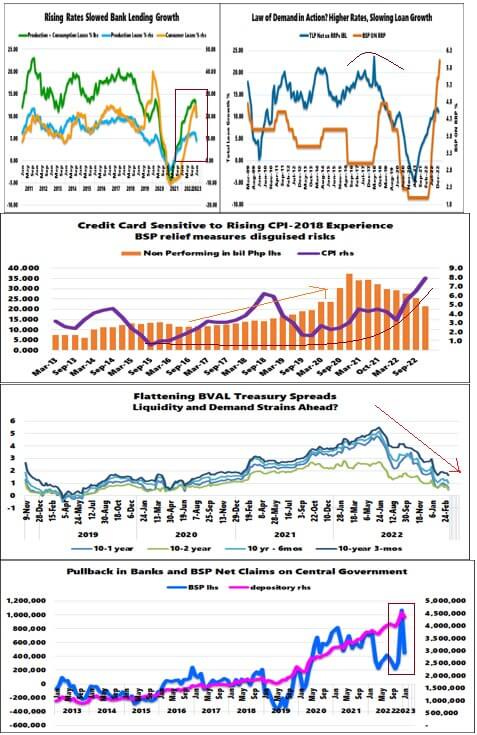

The BSP started its aggressive rate hikes in May 2022. Yet, bank loan growth accelerated over the last nine months. It was in January 2023 when signs of a credit growth slowdown emerged.

And history hasn't rhymed. Bank lending began to decline as the CPI pushed higher and ahead of the BSP rate hikes in 2018, which escalated its cascade.

The difference in the reaction of lenders today lies with other embedded policies.

Except for consumer spending, the supply-side Universal-Commercial bank credit growth rate materially declined last January. Even blazing consumer credit has emitted signs of exhaustion. (Figure 5, topmost chart)

In any case, due to the plunge in auto loans (-4.4%), the UC consumer YoY and MoM growth rates last January plummeted to 20.26% and -.6% from 25.12% and 1.74% in December, respectively. (Figure 4, second to the lowest window)

The BSP and the consensus didn't see the inflation coming. Through the present, they continue to deny it. This denial only shows the reactionary nature of their policies.

My humble guess is that they are clueless about the effects of the inflation "cat-and-mouse game" which they underwrote—such that they will have little idea of the unintended consequence of their rate hikes.

Despite the relief measures, January NPLs have begun to rise. (Figure 4, lowest window)

Figure 5

During the 2015-2018 inflation episode, credit card delinquency rose along with the CPI. It worsened when the CPI fell! (Figure 5, second to the highest pane)

The waterfall in bank lending/rise in NPLs signified diminishing demand, which authorities covered with aggressive deficit spending.

The important thing to drive at is that the present decline of the NPLs has not been a consequence of balance sheet recovery but from the subsidies of the BSP—particularly the variable relief measures and liquidity interventions.

Once credit delinquency growth gains upside momentum, we can only surmise what the BSP will do and the nature of their response/s given the latest actions as our blueprint.

And yes, we may be seeing peak inflation for this second wave. The first wave was in 2015-2018. The cracks in bank lending have emerged while Treasury markets exhibit a sharp tightening. (Figure 5, second to the lowest pane)

Furthermore, both banks and the BSP have scaled down their liquidity interventions. The BSP has reversed most of the December injections. (Figure 5, lowest chart)

But the coming CPI slowdown may be a transition to a more potent third wave—all of which will be anchored on the path dependency politics of deficit spending by the executive branch and the priority of maintaining and expanding liquidity by the BSP.

Plus ça change, plus c'est la même chose.

Or, the more things change, the more they remain the same.

____

References

Prudent Investor, Q4 2022’s Historic Deficit Spending! Economic Freedom Rating Plunged Due to Fiscal Health, The Inflationary Financing of Deficits March 5, 2023 Substack, Blogger

Prudent Investor, The Wilcon Depot Boom: A Beneficiary of Government Induced Inflation? Substack, Blogger March 6, 2023

Keynes, John Maynard, Keynes on Inflation Excerpts from The Economic Consequences of the Peace by John Maynard Keynes, 1919. pp. 235-248 pbs.org