Peak 2nd Wave Headline Inflation as CORE CPI at 22-Year High! Bullish PSEi 30 from Low Rates? Philippine Yield Curve Inverts!

Headline CPI slowed considerably in April, while core CPI remained at a 22-year high! The Philippine yield curve inverts. Has falling CPI been bullish for the PSEi 30?

Central bankers always try to avoid their last big mistake. So every time there's the threat of a contraction in the economy, they'll over stimulate the economy, by printing too much money. The result will be a rising roller coaster of inflation, with each high and low being higher than the preceding one—Milton Friedman

In this issue

Peak 2nd Wave Headline Inflation as CORE CPI at 22-Year High! Bullish PSEi 30 from Low Rates? Philippine Yield Curve Inverts!

I. Peak 2nd Wave Inflation: April CPI Fell to 6.6% as CORE CPI Remained at 22-Year High!

II. Wilcon Depot’s Sales Resonated with the Furnishing and House Equipment CPI

III. Peak 2nd Wave Inflation: The Plunge in Q1 2023 Fiscal Spending

IV. Peak 2nd Wave Inflation: A Turning Point in Bank Lending?

V. Peak 2nd Wave Inflation: Stagflation in the Manufacturing Sector

VI. Peak 2nd Wave Inflation: BSP Expands Liquidity Operations but Currency Issuance Slumped!

VII. Peak 2nd Wave Inflation: Philippine Yield Curve Inverts

VIII. Yield Curve Inversion Reflects Tightening Banking and Financial Conditions

IX. Peak 2nd Wave Inflation: Those Who Cannot Remember the Past are Condemned to Repeat It (NPLs, 3Rs and Systemic Mismatches)

X. Reality Check: the PSEi 30 Have Barely Been Bullish on a Lower CPI and Decreasing Rates

___

Peak 2nd Wave Headline Inflation as CORE CPI at 22-Year High! Bullish PSEi 30 from Low Rates? Philippine Yield Curve Inverts!

I. Peak 2nd Wave Inflation: April CPI Fell to 6.6% as CORE CPI Remained at 22-Year High!

When the Philippine Statistics Authority (PSA) declared February's statistical inflation, or the CPI, at 8.6%, we suggested that this represented the peak for this cycle. (bold and italics original, chart references excluded)

And yes, we may be seeing peak inflation for this second wave. The first wave was in 2015-2018. The cracks in bank lending have emerged while Treasury markets exhibit a sharp tightening.

Furthermore, both banks and the BSP have scaled down their liquidity interventions. The BSP has reversed most of the December injections.

But the coming CPI slowdown may be a transition to a more potent third wave—all of which will be anchored on the path dependency politics of deficit spending by the executive branch and the priority of maintaining and expanding liquidity by the BSP. (Prudent Investor, 2023)

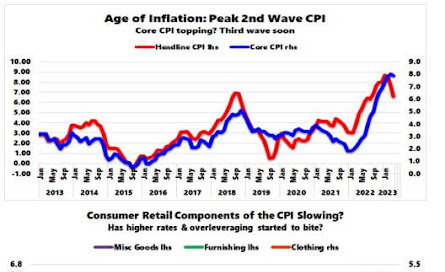

Figure 1

The third monthly decrease, which lopped off 210 bps from the 8.7% peak, certainly looks like "peak CPI."

Second, despite the maundering of authorities in the media, again pointing to supply-side sources, the BSP confirmed what we have been saying all along; its driver has been demand-pull inflation. But in the May report, they referred this to the Core CPI.

Headline inflation eased further to 6.6 percent year-on-year in April from 7.6 percent in March, well within the BSP’s forecast range of 6.3-7.1 percent for the month. The resulting year-to-date average of 7.9 percent, however, is still above the Government’s average inflation target range of 2.0-4.0 percent for the year. Core inflation, which excludes selected volatile food and energy items that depict underlying demand-side price pressures, also declined marginally to 7.9 percent in April from 8.0 percent in March. On a month-on-month seasonally adjusted basis, inflation remained nil in April. (BSP, 2023)

While the headline CPI did plunge, the Core CPI stubbornly remained at a 22-year high! (Figure 1, topmost chart)

The stark difference tells us of diverse liquidity conditions in the economy and variable dynamics of consumer preferences.

That is to say, the transition to a "reopened" economy saw a makeover of consumer spending from food to non-food items. Aside from fiscal spending, bank credit financed most of such activities.

However, tighter credit conditions from the BSP policies and bank internal developments recently curtailed the spread of inflation.

II. Wilcon Depot’s Sales Resonated with the Furnishing and House Equipment CPI

Micro developments reinforce the Macro panorama.

While the BSP has yet to report on March bank credit activities, Q1 2023 financial statements from a few PSEi firms suggest that consumer credit and even supply-side credit remained robust.

Thus, the CORE CPI represented by non-food products dropped by only a notch. For instance, while clothing and personal and miscellaneous goods and services sustained their increases, household furnishing appears to have topped. (Figure 1, middle window)

Perhaps, moderating sales of the premier retailer of home improvement and construction supply—Wilcon Depot [PSE: WLCON]—may have resonated with the slowing pace of increases in furnishing, household equipment, and maintenance.

While Wilcon's sales growth subsided, it remained brisk in Q1 2023. It grew by 11.44% but represented the lowest rate since Q4 2021. (Figure 1, lowest diagram)

By quarter, WLCON's topline was down by a marginal 3.6%. WLCON's revenues have closely tracked bank credit card activities.

In the context of the GDP, while consumer activities might have slightly lowered the nominal/current figures, high inflation rates are likely to trim its real "growth."

III. Peak 2nd Wave Inflation: The Plunge in Q1 2023 Fiscal Spending

Next, most of the principal causal factors behind the raging CPI continue to exhibit a downshift.

As a caveat, while "too much money chasing too few goods" signifies the primary cause of inflation, we do not deny the subsidiary contribution from supply-side factors.

But supply-side shocks tend to be fleeting when money and prices are allowed to function normally.

For instance, when people do not have money to buy, how can there be inflation?

Also, how would inflation emerge or even last when people trade via barter (exchanging goods/services for goods/services)?

Inflation develops when the public has increased purchasing power (money) disproportionate to the availability of goods and services.

And one of the fundamental functions of a central bank fiat monetary standard is to keep liquidity—represented by money and credit—growing.

The likely downshift in credit-financed public spending, bank credit, and BSP liquidity operations signifies the fundamental reasons for the slowing CPI.

Let us deal with them. First, the Q1 2023 plunge in public spending.

Figure 2

Though public spending declined by only 1.06% in Q1 2023, the first since Q3 2020, this represented a steep fall from the record Q4. The average quarterly growth YoY in the last two years was 10.8%. Moreover, Q1 2023's Php 1.089 trillion dropped to the level of Q1 2021's Php 1.02 trillion. (Figure 2, topmost chart)

By extension, the sliding growth of the PSA's construction materials wholesale index (a measurement of prices of government spending on public works), construction materials retail (NCR) prices (some used for public works), and BSP's loans to the construction sector have reinforced the deceleration in public spending.

While the wholesale material prices slipped to 7.7% in March from 9.11% in February, retail material prices dipped to 4.1% from 5.4% over the same period. (Figure 2, second to the highest chart)

Meanwhile, total bank construction loan growth slowed to 12.1% in February from 12.9% in January.

The slowing of demand from the public sector represented a significant factor in reducing street prices.

IV. Peak 2nd Wave Inflation: A Turning Point in Bank Lending?

Bank credit conditions are the next in line.

While the March BSP depository survey has yet to be released, we'll settle for the data of the first two months of Q1 for clues.

After peaking in November 2022 at 13.59%, lending by universal commercial banks has slackened, posting a 10.23% and 9.85% in January and February 2023. (Figure 2, second to the lowest window)

The slowdown in bank credit expansion was almost exclusively a supply-side phenomenon but was substantial enough to drag down the aggregate.

Despite this, consumer credit remained on the boil.

Growth of credit cards (30.7% in January and 29.4% in February) and salary loans (67% and 69.3%) have spiked to all-time highs (ATH)!

Rocketing credit cards and salary loans have directly financed the non-food expenditures to reflect the surge in the CORE CPI.

While credit cards may be exempt from rising rates—due to interest caps—"higher for longer" will take a bite out of credit expansion for the rest of the segments.

And it should be more than just higher rates.

For balance sheets, the intensity of leverage will matter. It applies to individuals, households, proprietors, partnerships, corporations, and the public sector.

With the massive demand brought forward to generate a strong GDP through credit, the payback will also be profound.

Once credit growth tapers substantially or even suffer from deflation, so shall these be reflected on the top line of firms, the CPI, and the GDP.

V. Peak 2nd Wave Inflation: Stagflation in the Manufacturing Sector

Inventory could also be a factor. A bullwhip effect may shock economic agents, such as suppliers, producers, and builders, expecting a sustained boom when credit expansion slows substantially. Excess stockpiles or inventories may afflict them.

The obligation to raise financing may impel liquidations below the cost of production or even at fire sale prices.

According to S&P Markit, domestic manufacturers struggled last April

Contributing to the softer uptick in business conditions across the Filipino manufacturing sector was a relatively muted upturn in new business. The rate of growth was the weakest in the current eight-month sequence of expansion amid reports of increased market competition and softer demand. In contrast, April data suggested much sturdier demand for Filipino manufactured goods from foreign markets, as new export orders grew at a strong pace. In fact, the rate of expansion quickened to the joint-fastest in nearly two years. In line with the softer uptick in new business, firms also expanded their output, but at the weakest pace in six months. (S&P Global PMI, 2023)

Despite the inflationary boom, the sector shed jobs.

Furthermore, widespread reports of resignations resulted in a third consecutive monthly contraction in payroll numbers across Filipino manufacturing firms in April. Though the rate of job shedding was marginal, firms linked this to difficulties in retaining staff. Moreover, alongside reports of staff shortages, firms also noted that material scarcity and delivery delays resulted in a second successive month of backlog accumulation.

But a slower pace of increase in input cost and sales prices.

At the same time, material shortages, higher prices at suppliers, and the strengthening dollar resulted in a further rise in costs faced by manufacturers. That said, the rate of input price inflation softened to a 30-month low in April. Additionally, the latest rate of increase was weaker than the series average. In line with subsiding cost pressures, the pace of charge inflation also slowed during April. Manufacturing firms raised their charges at only a marginal pace. The rate of increase was the softest in 28 months.

And with the slowing growth of manufacturing bank loans supporting the weakening output, the Producer Price Index (sales prices of producers) has also been falling. (Figure 2, lowest chart)

Weaker output, higher prices, and lower jobs define stagflation.

VI. Peak 2nd Wave Inflation: BSP Expands Liquidity Operations but Currency Issuance Slumped!

Unknown to most, the BSP seems to be expanding its liquidity operations, but it has been getting different results.

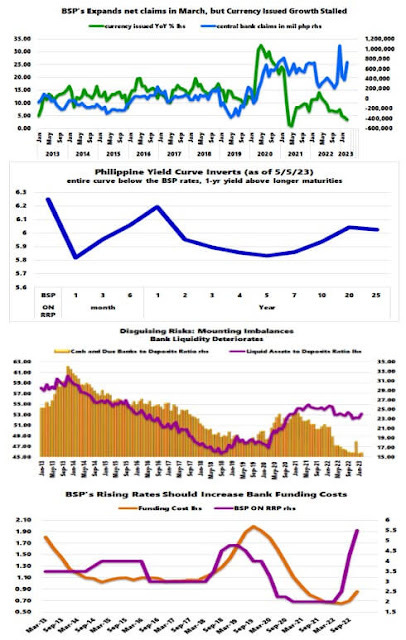

Figure 3

And though the BSP's net claims on central government surged by 120% in March, its growth of currency issuance slumped to 3.5%--the lowest since May 2021. (Figure 3, topmost window)

After peaking in April 2022, currency growth, reflecting M1’s cash in circulation, has been on a steep downtrend. It exhibits a substantial tightening of financial liquidity.

We exclude in this discussion the banking system's net claims on central government, which has served as the alternative but major source of liquidity injections.

In any case, other than the banks, the non-financials thru Other Financial Corporations (OFC) have also been tasked with liquidity interventions. (bold mine)

The rise in the OFCs’ domestic claims in Q4 2022 was due to their higher claims on depository corporations (DCs), on central government and on other sectors.2 In particular, the OFCs’ claims on DCs expanded owing mainly to the growth in the sector’s deposits in banks and holdings of bank-issued equity securities. Likewise, the OFCs’ claims on central government grew on account of increased holdings of government securities. (BSP, 2023)

OFCs have also added liquidity by acquiring bank securities. Yes, OFC's acquisition of equities may have spurred the recent spikes in prices of PSEi 30 banks.

VII. Peak 2nd Wave Inflation: Philippine Yield Curve Inverts

And symptoms go beyond the money supply.

Even after the April CPI announcement, the BSP's official overnight rate (ON RRP) has been higher than the rest of the benchmark BVAL curve. (Figure 3, second to the highest window) This represents a full inversion of the Philippine yield curve.

Further, the Short-term Interest Rates (STIR) or yields of T-bills continued to climb as rates of the rest of the middle (belly) and longer end have stagnated. As such, the yield of the 1-year Treasury pays more than the longer curve.

The reticent treasury traders appear to be defying their more popular equity peers, the latter are "bullish" on the economy. We hardly hear them, but the curves reveal a powerful but revealing message.

But the thing is, rising T-bill rates exhibit higher time preferences (increased choice for immediate gratification or the tilt towards short-term orientation) expressed as expanded demand for short-term financing and, most possibly, increased demand for collateral to back such credit transactions.

VIII. Yield Curve Inversion Reflects Tightening Banking and Financial Conditions

The recent tightening of liquidity represents a function of the banking system.

As of February, the cash-to-deposit ratio is at its lowest level since at least 2013. (Figure 3, second to the lowest diagram)

Though both factors have been on a downtrend, bank cash reserves have been deflating (YoY %). Or cash reserves have dropped faster than deposits.

There is more. With increasing interest rates, the funding costs of the banking system will likely rise too, which should not only squeeze interest spreads but also reduce the quantity of bank credit transactions. (Figure 3, lowest pane)

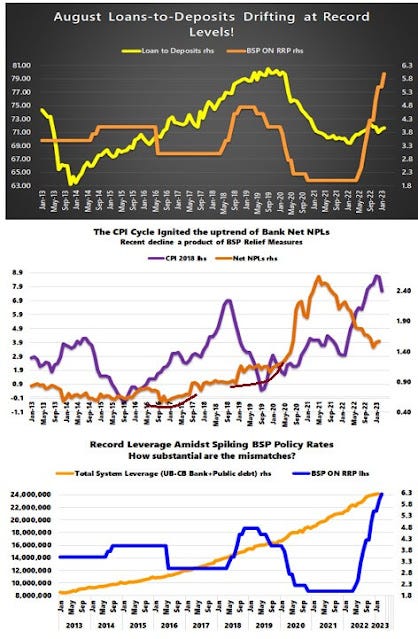

Figure 4

If history should rhyme, like in 2019-2020, the loan-to-deposit ratio could turn south again. (Figure 4, topmost pane)

IX. Peak 2nd Wave Inflation: Those Who Cannot Remember the Past are Condemned to Repeat It (NPLs, 3Rs and Systemic Mismatches)

Yes, that’s a warning from philosopher George Santayana.

It would be a mistake to forget that the banking system's Non-Performing Loans (NPL) emerged when the CPI pivoted downward in 2018-2019.

Or, the ascent of NPLs started in 2015-2016, picked up tempo in 2019, and accelerated in 2020. (Figure 4, middle pane)

The BSP's historic relief measures, which constituted part of the most aggressive rescue package, have clouded the actual conditions of banks. Despite the hazy backdrop, the relief measures allowed the banks to undertake lending.

Because of the erosion of liquidity, the BSP cut the bank's reserve requirements twice in 2018 and thrice in 2019—rationalized as the adaption of a global standard---and started to cut rates in April 2019.

In the meantime, the banking system intensified its holdings of the net claims of the Central government in 2019 too.

The point is, financial tensions surfaced in the aftermath of peak first-wave inflation.

Seen holistically, it has been no coincidence that the design of these measures had been to alleviate the developing stress from the banking and financial system.

Don't just take it from me.

In two consecutive Financial Stability Reports, the BSP expressed its concerns, which we have shown before and will show again to remind our readers: (bold added)

In 2018…

While there is no definitive evidence of a looming crisis, it is also clear that shocks that have caused dislocations of crisis proportions have come as a surprise. What is not debatable is that repricing, refinancing and repayment risks (3Rs) are escalated versus last year and this could result in systemic risk if not properly addressed in a timely manner. (FSCC, 2018)

In 2019…

If there are risk issues to raise, it will have to be the prospects of managing liquidity. Aside from simply having more loans versus deposits, using liquid assets as a source for funding more earning assets needs our attention. However, the bigger issue will be that continuing on the path of being a bank-based financial market means that the provision of credit will require taking on mismatches in tenor and in liquidity. As more credit is dispensed, such mismatches will only increase. Certainly, the banking industry has been able to sustain itself despite these mismatches but moving forward, there is value to providing other avenues to alleviate the pressures on the banking books. (FSCC, 2019)

Unfortunately, this genre of warnings has vanished from their recent FSRs even as the scale of risks has intensified via increased leveraging, therefore mismatching.

And rates have spiked amidst historic leveraging of the financial system: How systemic are the (tenor & liquidity) mismatches to require adjustments in repricing, refinancing, and repayments? Why have the cash and liquidity conditions of the banking system been deteriorating? (Figure 4, lowest chart)

X. Reality Check: the PSEi 30 Have Barely Been Bullish on a Lower CPI and Decreasing Rates

Finally, stocks ought to rise when rates go down! So says the mainstream experts.

Figure 5

But that's exactly the opposite of evidence. As shown, in the era of easy money, diminishing returns have plagued stock market yields. (Figure 5, upper chart) Importantly, it has also increased various forms of risks (e.g. market risk, concentration risk, and more).

Further, share prices tend to rise along with higher inflation during the upside phase of the stock market cycle, or the PSEi 30's returns increased when the CPI went up as in the 2015-2017 and 2020-21 episodes. (Figure 5, lowest window)

Why? Because excess liquidity diffuses into financial assets first before flowing to goods and services later.

But since financial assets compete with economic goods and services, lower savings and disposable income from the diminishing purchasing power of the currency (peso) leads people to redirect expenditures towards the latter (necessities).

In this case, some people sell assets to fund household or business expenditures. Or, insufficient savings and income put downward pressure on financial assets, which also implies a build-up of credit risks.

Excessive balance sheet gearing in the face of inadequate income and rising rates also puts pressure on financial assets.

In the end, monetary-induced booms morph into a bust. Central banks, like the BSP, and political authorities (Executive and Legislative branches) will likely respond in the same template—by cutting rates, infusing liquidity, suspending transparency, employing fiscal "stabilizers" (deficit spending), mandating credit allocations to specific groups, enforcing price controls, and more.

Under such a paradigm, a stronger third wave of inflation should emerge.

We close with a quote from the opening,

But the coming CPI slowdown may be a transition to a more potent third wave—all of which will be anchored on the path dependency politics of deficit spending by the executive branch and the priority of maintaining and expanding liquidity by the BSP.

Yes, the CPI may have peaked now, but economic pressures will force authorities to unleash the next (3rd) wave of inflation.

____

References

Prudent Investor, Philippine Core CPI Forged a New 22-year High! Signs of Peak 2nd Wave Inflation: Pullback in Bank Lending and BSP Injections March 12, 2023: Substack, Blogger

Bangko Sentral ng Pilipinas, Inflation Drops Further to 6.6 Percent in April, May 05, 2023, bsp.gov.ph

S&P Global PMI, S&P Global Philippines Manufacturing PMI April data signals softer growth across the Filipino manufacturing sector, May 2, 2023

Bangko Sentral ng Pilipinas, Domestic Claims of Other Financial Corporations (OFCs) Increased by 8.1 Percent YOY in Q4 2022, April 28, 2023

FINANCIAL STABILITY COORDINATION COUNCIL, 2017 FINANCIAL STABILITY REPORT, June 2018 p.27, bsp.gov.ph

FINANCIAL STABILITY COORDINATION COUNCIL, 2018 H1-2019 H1 FINANCIAL STABILITY REPORT, September 2019 p.19, bsp.gov.ph