November CPI Spikes to 14-Year Highs! Is the BSP Inflating Away the Record Public Debt Levels? Consumer Leveraging Rockets!

Last week, the November CPI printed 8%, a 14-year high, which came in the light of October's public debt at Php 13.64 trillion. Have authorities been silently inflating away its mountain of debt?

Inflation is not caused by the actions of private citizens, but by the government: by an artificial expansion of the money supply required to support deficit spending. No private embezzlers or bank robbers in history have ever plundered people’s savings on a scale comparable to the plunder perpetrated by the fiscal policies of statist governments—Ayn Rand

In this issue

November CPI Spikes to 14-Year Highs! Is the BSP Inflating Away the Record Public Debt Levels? Consumer Leveraging Rockets!

I. The Political "Gaslighting" of Inflation

II. Economic Trends Versus the Religious Cult of "Peak Inflation"

III. Enumerating the Supply-Side Imbalances

IV. Inflating Away the Record Debt Levels!

V. Demand-Pull Inflation: Savings Drawdown and Explosive Growth in Salary and Credit Card Loans!

VI. Why a Ramp Up on Financial Assets Translates to "Sticky Inflation" and " Why PSEi 30 Favors an Elevated CPI than the BSP’s "Pivot"

November CPI Spikes to 14-Year Highs! Is the BSP Inflating Away the Record Public Debt Levels? Consumer Leveraging Rockets!

Last week, the November CPI printed 8%, a 14-year high, which came in the light of October's public debt at Php 13.64 trillion. Have authorities been inflating away its rapidly expanding mountain of debt thru deficit spending and bank credit expansion?

I. The Political "Gaslighting" of Inflation

Both the headline and the core CPI reached a 14-year last November.

BSP, December 6: Headline inflation rose in November to 8.0 percent year-on-year, the highest level observed since November 2008, but within the BSP’s forecast range of 7.4-8.2 percent. The year-to-date average of 5.6 percent is above the Government’s announced inflation target range of 2.0-4.0 percent for 2022. Core inflation, which excludes selected volatile food and energy items to measure underlying price pressures, also increased to 6.5 percent in November from 5.9 percent in the previous month. Meanwhile, month-on-month seasonally-adjusted headline inflation slowed down to 0.7 percent in November from 1.0 percent in October. (italics added)

It is amusing to see how authorities stubbornly deny the numbers churned by their agencies.

After disclosing the headline and the core CPI numbers that exceeded their estimates, the BSP shifted to using seasonally-adjusted numbers to illustrate the supposed slowing velocity of the CPI. Seasonal adjustments filter or eliminate the seasonal variations of the time series. (Bernales, 2010)

There is no contention here about the use of seasonally adjusted data. Instead, the cherry-picking of it to sanitize the CPI, i.e., using seasonal adjustments compared with the gross, seems to represent a switch and bait skullduggery.

Sure, the original Core CPI growth slowed to .8% from .95% (MoM), but the headline CPI growth remained at .9% in November from a month ago.

Even at a slower month-on-month rate, the CPI has still been climbing. The number does not guarantee that this represents a "peak" in the CPI.

Yet, the hard-earned money of the average citizenry continues to shed purchasing power, regardless of what statistics say.

Figure 1

As an example, the residents of the Philippines are one of the top countries suffering from inflation anxiety this Christmas, according to Statista. (Figure 1, upper chart) Again, inflation is not about statistics.

But it is a boom for the tax consumers, as explained below.

No wonder Merriam-Webster assigned "gaslighting" as the word of the year.

Weaponizing political language via gaslighting has become a dominant communication tool in social media.

II. Economic Trends Versus the Religious Cult of "Peak Inflation"

But people are so forgetful.

From time immemorial, the establishment declared rising inflation as "transitory." And when it spiked, inflation morphed into different politically convenient forms: "supply shocks," "imported inflation," and the "strong USD."

Presently, inflation has adorned the mantle of "peak inflation."

But neither has the consensus seen this inflation crisis coming nor the panicked response by the BSP.

Paradoxically, everyone seems to anchor their expectations on the hope that the blind will eventually succeed in their goals.

Yet, despite the various forms of "gaslighting" as part of the communications strategy of "plausible deniability" to whistle past the inflation graveyard, their CPI data tell us a different reality.

First, the 25-year CPI chart, which combines the different time series, cements the breakout of the reverse head and shoulder pattern, reinforcing its uptrend since 2015. (Figure 1, lower chart)

The pivotal U-turn, a likely secular uptrend, runs in contrast to popular wisdom.

But trends don't roll on a straight line, which means countercyclical dynamics will occur. The momentum spike will eventually stall, resonating sharply overbought conditions, and a slowdown or pullback follows. The 2018-2019 hiatus could be an archetype.

The trend character of the CPI will likely be "higher highs and lower lows."

But overall, a secular trend means long-term.

Furthermore, the base rates of the CPI also matter.

Had the CPI been calculated using the 2012 base, November's 8% would probably be around 8.5%. Under the 2006 time series, the CPI would probably be closer to 9%.

And there are direct and indirect price controls (SRPs) on basic commodities.

And the surveys barely capture transactions in the informal or the "shadow" economy.

Despite the statistical alchemy designed to suppress it, the CPI continues to defy establishment expectations!

For want of doubt, the CPI trend exposes the "fatal conceit" of central planning, built from the foundations of presumptive econometrics or quant-based economics!

Then, the relationship between the CPI and oil prices and the USD Php.

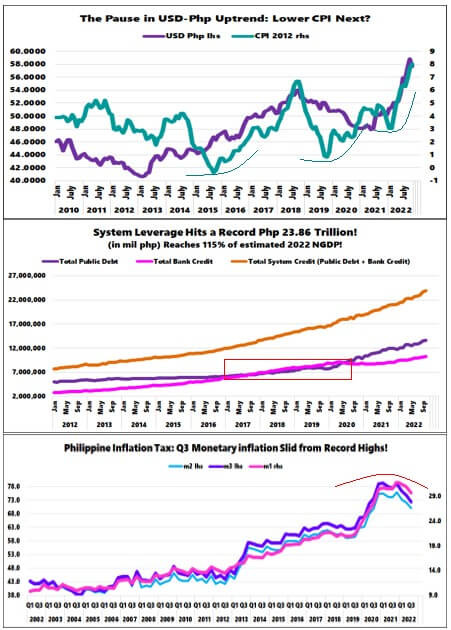

Figure 2

In its second inflation wave, the Philippine CPI turned the corner in October 2019, SIX months ahead of the bottom of oil prices in April, benchmarked by the West Texas Intermediate (WTI). [Figure 2, upper chart)

This divergence exhibits the domestic aspect or origins of inflation.

And while WTI oil prices have temporarily peaked in May 2022, the upside momentum of the domestic CPI continues, accentuating the push from domestic factors.

Meanwhile, the non-food and non-energy CORE CPI aligned with its broader-ranged peer to reach multi-year highs. It means that price pressures have not only been "sticky" but have diffused into the broader economy!

The non-food retail components of the CPI, which include personal care & miscellaneous goods, clothing and footwear, and household furnishing, roared in November! (Figure 2, lower window)

How can the establishment assert that these represent "inelastic demand" or "supply shocks?"

And here is the thing.

The BSP frequently diverts the public's attention from the inflation issue to the actions of the US Federal Reserve. But the local inflation rate caught up with the US at 7.7% last October. If the slowdown in the US CPI persists in November, then domestic inflation should surpass the former. The BSP's actions, justified on (real) rate differentials, are untenable.

So yes, oil prices may have a material influence, but domestic imbalances have also contributed considerably to the present inflation crisis.

Again, it is noteworthy to emphasize that domestic inflation pivoted in 2019, ahead of oil prices.

Figure 3

Meanwhile, the CPI led the USD Php in the last turning point in October 2019 by about EIGHT months. (Figure 3, topmost pane)

Their relationship goes to show that domestic factors have propagated the spike in the USD. The problem is, aside from reaching overbought levels, the latest correction of the USD Php has been a function of intense market interventions by authorities, which we will discuss soon.

To be clear, credit-financed demand from easy money policies has magnified its imbalances with the supply side.

III. Enumerating the Supply-Side Imbalances

Let us not forget that supply-side dislocations signify an outgrowth of an aggregation of political and economic forces here and abroad over time. Here are the major contributors.

1) The credit bubble malinvestments.

Overinvestments piled on into finance, financial assets, ESG (renewable) energy, real estate, and technology (including the crypto bubble).

The easy money regime also spurred the swelling of the welfare and warfare states channeled through record deficit spending. How do you think the Russo-Ukraine war has been financed?

Conversely, traditional fuel (oil, natural gas, coal, nuclear energy), commodity, and food production suffered from decades of underinvestments.

2) The economic shutdown in response to the pandemic severely disrupted and led to the discoordination of the division of labor, subsequently, to capital losses.

3) The pre-Ukraine war mercantilism and,

4) The broader scope of the kinetic conflict in Ukraine through expanded economic and financial war (e.g., expanded mercantilism and various forms of financial and trade sanctions).

The rising USD is a symptom and a second-order cause. It is not the primary factor.

IV. Inflating Away the Record Debt Levels!

As explained last week, since political authorities are the primary beneficiary of inflationary policies, returning the inflation genie to his confinement lamp seems like a dubious proposition.

Here is a summary of the accruing benefits of inflationist policies for political authorities:

-higher GDP (but GDP is not the economy)

-increased tax revenues,

-more political spending,

-amplified reliance on political solutions for socioeconomic predicaments: a crisis magnifies its dependency.

-the ability to inflate the public debt away, and

-consolidates and expands political control over the society

It's like telling the leadership and their bureaucracy to restrain or curtail their control over society. And that's not about to happen anytime soon.

Public debt, for instance, expanded by 13.64% in October to etch a new milestone at Php 13.64 trillion.

Yet, the consensus tirelessly assures the public that the economy will outgrow debt as measured by the debt-to-GDP ratio.

But the debt-to-GDP ratio is a misleading gauge of risk.

To begin with, public debt is a product of deficit spending. And deficit spending is part of the GDP. Since the numerator represents the product of the government side of the (GDP) denominator, the ratio entails circular reasoning. That is, more deficit spending, which helps push the GDP higher, equals more debt.

Carried through its logical conclusion, if authorities relied on public spending as the primary or even sole driver for its growth model, wouldn't the outcome be a debt crisis?

Next, the fiscal gap is financed primarily by the private and non-government sectors. But since public spending has been capturing a bigger slice of the economy, this entails reduced financing and resources available to the wealth generators. Having said so, with the sustained squeezing of wealth generators, how will the latter pay for the former's debt? By manna from the heavens?

But there's more.

The consensus would like us to believe, similar to the last decade, an outgrowth of the GDP will hack into public debt. But there is something they don't say. The slowdown of public debt merely transferred the onus of leveraging into the banking system.

Bank credit eclipsed public debt in 2016 through the Q2 of 2020. But then, the pandemic-induced recession required sustained liquidity levels to keep asset prices or collateral values afloat. And so, the public debt took over. As of October, system leverage accounted for about 115% of the estimated annual NGDP. (Figure 2, middle window)

In this way, leveraging risks moved out of the public sector but shifted into the banking system!

Transferring risks disguises rather than eliminates them.

But today, systemic leveraging has been running on full steam from both engines (public and private sector) to promote the political agenda through inflationist policies!

That is, mounting leveraging risks continue to accumulate in the balance sheets of the public and private sectors.

And as further proof, the GDP has become increasingly dependent on liquidity growth from the BSP and banking system. M3 to GDP culminated at 79.4% in Q4 2020 and has then retraced to 72.5% in Q3 2022. (Figure 3, lowest pane)

But liquidity growth has been stalling. It foreshadows a credit slowdown that should adversely impact a credit-dependent economy, a development that the consensus severely underestimates.

Figure 4

Nonetheless, the accelerating CPI, which reached a multi-high year, has been accompanied by an unparalleled fiscal deficit. (Figure 4, top chart)

Needless to say, authorities have used inflation to dilute away the outstanding debt!

V. Demand-Pull Inflation: Savings Drawdown and Explosive Growth in Salary and Credit Card Loans!

Of course, as we have been saying, it is not just the fiscal deficits contributing to the "demand-pull inflation."

The other critical financial factors behind the simmering growth in consumer spending are the 1) spillover effects of 2020 BSP's historic injections to rescue the banking system, 2) the May 2022 election money, and 3) the substantial drawdown in bank savings. And the most conspicuous factor has been 4) the explosive growth in consumer borrowing from banks!

In response to the BSP's unprecedented liquidity injections, cash-in-circulation growth spiked by over 25% (YoY) from April 2020 to February 2021 (11-months)! (Figure 4, lower chart)

A crash in the growth rate followed. It fathomed to a low of 3.9% in May 2021, then picked up its tempo in the Q3 until the May national elections proper. Although the growth rates have not been as fast as the 2020 version, on a notional basis, it piggybacked on a very high base!

Upon the unmatched liquidity injections by the BSP, the M2 savings growth rate also rebounded, plateaued, and crashed simultaneously with cash in circulation.

Unfortunately, election spending cash didn't percolate into savings growth. As a result, while the May elections fueled a rebound in cash circulation, savings growth sustained its southbound trek.

Savings barely saw a semblance of growth in September (+.6%) and was flat in October (0%) 2022, suggesting a substantial drawdown by bank account holders.

And consumers have become a focal point of bank lending.

Figure 5

In aggregate, consumer borrowing, primarily from credit cards, posted the second-highest amount after the financial industry (month-on-month). (Figure 5, topmost chart)

And though the authorities declared that the labor force improved marginally to 95.5% in October from 95% a month ago, principally due to the drop in labor force participation (headed towards the holiday), bank-registered salary loans rocketed by 62.8% to a record Php 122.25 billion!

The salary loan portfolio has exploded by over 40% growth in the last four months! (Figure 5, middle window)

On top of the salary loans, the record-streaking growth in bank credit card loans accelerated in October (26.8%) to another record (Php 522 billion)! Its % share of the total loan outstanding has equaled the February 2020 high of 4.9%! (Figure 5, lowest pane)

As previously elaborated, aside from augmenting the loss of purchasing power through increased leveraging, the intensified borrowing represents a textbook reaction to the interest rate cap on credit cards, which should adversely impact creditors over time.

The nosebleed speed of consumer borrowing has eclipsed the production loans, accentuating excess consumption spending financed by increased leveraging even as interest rates rise!

So yes, while excess spending by the public sector and consumers may deliver the political GDP objectives in Q4 and the annual target, it comes with mounting risks to their balance sheets and of their counterparties or creditors, primarily the banks and the financial industry.

Figure 6

The distribution of bank lending likewise reveals the reason behind the CPI sustained increases.

That is to say, the escalating high-time preferences (short-term orientation) of the public, exhibited by intense borrowings for immediate gratification, continues to crowd out investments or production capacity build-up on the supply side. (Figure 6, highest chart)

This data showcases the maxim, "too much money chasing too few goods!"

VI. Why a Ramp Up on Financial Assets Translates to "Sticky Inflation" and " Why PSEi 30 Favors an Elevated CPI than the BSP’s "Pivot"

But the demand-pull inflation doesn't stop here.

Actions in the financial markets also impact bank lending and vice versa.

At the end of last month, I wrote that a desperate bank-financial industry might be scaling up intra-industry loans to finance asset purchases on margins.

Bank lending to the financial sector has recently picked up steam. It grew by 9.9% in September. And the PSEi 30's enormous return of 7.2% last October might have been significantly influenced by it. (Prudent Investor, 2022)

And there it is, finance was the biggest MoM borrower of the banking system in November!

Bullseye!

Though bank loans to the financial industry posted an increase of a modest 12.78% in October, it was the 5th highest in nominal peso of Php 117.1 billion YoY. But the thing is, in peso, this sector ranked FIRST in borrowing (Php 28.44 billion) MoM, which likely had been instrumental for the PSEi 30's fabulous 10.2% MoM return last November! (Figure 6, middle window)

And more…

Ironically, rising asset prices should signal easing conditions that go against the essence of the BSP tightening.

Financial institutions may be resorting to extensive gearing to push asset prices higher. In turn, this should amplify the demand, specifically centering on the financial sector, which should have a spillover effect on others. The subsequent feedback should be on the prices of the real economy.

But aside from the interest cycle, the mainstream seems to have forgotten that there are second-order effects through solvency/insolvency conditions.

So there you have it.

The BSP gambles with asset inflation (bubbles), hoping it will save the day for the banks and financial institutions. (Prudent Investor, 2022)

By the same token, aside from the possible margin exposure of the financial industry, part of the increases in bank lending have likely percolated into the assets market (PSEi 30) in the form of manic bidding.

Again, the point is higher asset prices redound to the easing of financial conditions.

Also, higher asset prices elevate collateral values and place a premium on bank investments.

Since higher rates eventually should impact loan demand, the industry expects investments to bolster its financial statements in place of the former (loan books). Hence, the likely orchestrated push on financial assets.

As it is, asset prices partly reverberate the money flows into the real economy. Hence, the upside of the PSEi has been more correlated with the rise of the CPI than a "Pivot." (Figure 6, lowest pane)

After all, capital markets (fixed income and stock markets) exist to guide and facilitate asset allocation into the real economy.

Nevertheless, years of misallocations eventually translate to a "reversion to the mean."

Or, this time is "not" different.

Finally, because of time constraints, we defer discussions on the recent developments in the manufacturing sector to the next time.

___

References

Bersales, Lisa Grace; Enhancing Seasonal Adjustment of Philippine Time Series: Procedures under Seasonal, Annual BSP‐UP Professorial Chair Lectures 15 – 17 February 2010, bsp.gov.ph

Prudent Investor Newsletter, The Paradox of Q3 Philippine Banking Conditions: Record Peso Profits as Liquidity Corrodes Dramatically! November 29, 2022

Prudent Investor Newsletter PSEi 6,600: The Unseen Forces Behind the Mammoth Rebound November 28, 2022