BSP QE Variant 2.0 Confirmed! Historic Monetization of Public Debt by Financial Institutions! The Greatest Monetary Policy Experiment!

December money supply conditions validate the BSP's QE 2.0 variant. The financial sector joins the QE shindig. This represents the greatest experiment on the financial system and the economy.

The popularity of inflation and credit expansion, the ultimate source of the repeated attempts to render people prosperous by credit expansion, and thus the cause of the cyclical fluctuations of business, manifests itself clearly in the customary terminology. The boom is called good business, prosperity, and upswing. Its unavoidable aftermath, the readjustment of conditions to the real data of the market, is called crisis, slump, bad business, depression. People rebel against the insight that the disturbing element is to be seen in the malinvestment and the overconsumption of the boom period and that such an artificially induced boom is doomed. They are looking for the philosophers' stone to make it last—Ludwig von Mises

In this issue:

BSP QE Variant 2.0 Confirmed! Historic Monetization of Public Debt by Financial Institutions! The Greatest Monetary Policy Experiment!

I. BSP QE Variant 2.0 Confirmed: What The Right Hand Taketh Away, The Left-Hand Giveth

II. Bank Lending Data: What Tightening?

III. Historic Monetization of Public Debt by Banks and Financial Institutions!

IV. Peak Bank Consumer Debt? Peak Consumer Demand?

V. Reality is not Optional: The Greatest Experiment on our Financial System and the Economy

BSP QE Variant 2.0 Confirmed! Historic Monetization of Public Debt by Financial Institutions! The Greatest Monetary Policy Experiment!

I. BSP QE Variant 2.0 Confirmed: What The Right Hand Taketh Away, The Left-Hand Giveth

I was right about the BSP's stealth injections (variant QE 2.0) that resulted in a spike in their net claims on the central government.

During my report on the central bank survey, I wrote the following:

This time while the BSP has engaged in a series of "aggressive" rate hikes, it is reversing the tightening process implicitly by scaling down or liquidating its liabilities, including probably FX deposits of the Philippine Treasury.

Instead of more monetization of public debt, the BSP shed its liabilities, which makes it a variant. And this may be a prelude to cuts in the banks' reserves.

…

In turn, the torrent of liquidity flooded into Philippine financial assets, which propelled prices of the listed firms at the PSE (mostly PSEi banks) and domestic treasuries higher! (Prudent Investor, 2023)

As a result of the Php 764 billion drop in the BSP's liabilities (most likely deposits) last December month-on-month (MoM), net claims on central government soared to a record Php 1.07 trillion.

Other monetary data validates the BSP's stealth injections.

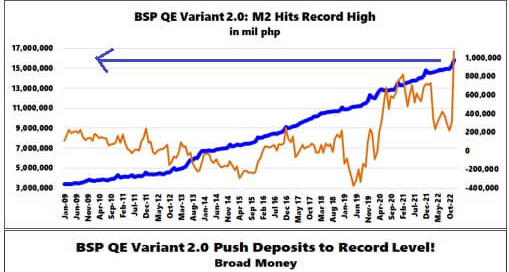

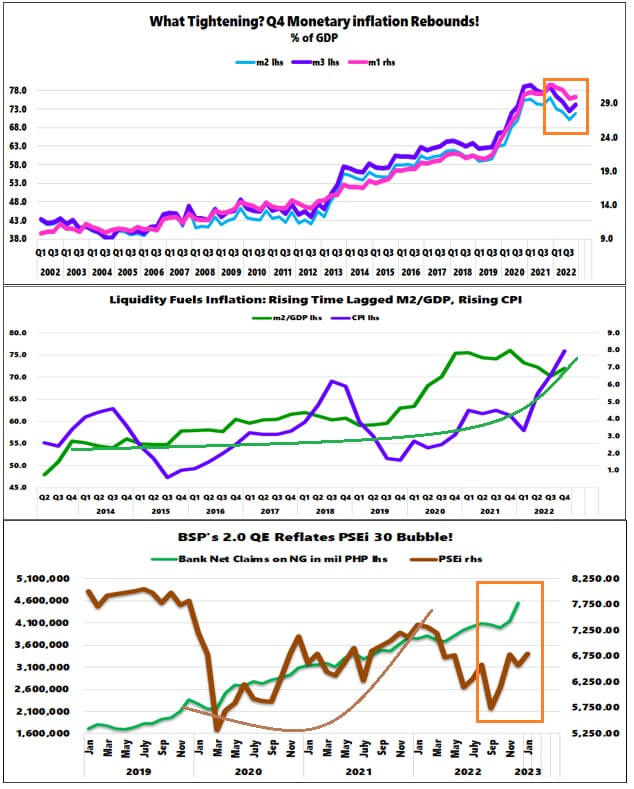

Figure 1

The December data on Depository Corporations Survey reveals that the broad money M2 segment represented by aggregate deposits surged by Php 439 billion (MoM), consisting of Php 258.7 billion and Php 180.7 billion, which flowed into savings and time deposits. (Figure 1, top and middle charts)

Consequently, the different money supply data posted All-Time High (ATH) levels.

Amazing.

And ATH will be the most used adjective in this discourse.

But here is the thing.

The BSP announces to the public that it is undertaking hikes in its policy rates to contain inflation.

But is it?

Actions speak louder than words. Or demonstrated preferences indicate that "what the right hand taketh away, the left-hand giveth."

II. Bank Lending Data: What Tightening?

The banking system evinced the critical effects of such liquidity interventions.

Not only has the banking system been aggressively lending in defiance of its 2018 behavior, but it has also been engaged in a bold campaign to infuse liquidity into the system by working with the BSP in monetizing public debt.

In 2018, the BSP rate hikes reinforced the downdraft in bank lending operations. Not today, yet. (Figure 1, lowest chart)

Universal and commercial bank credit expansion picked up its tempo after its reversal from deflation in August 2021. It reached its highest growth rate in November 2022, even as the BSP's policy rate reached 2008 levels. It posted a 12.11% growth last December, slower than November's 12.56%.

In peso, the banking system's credit portfolio reached an ATH last December!

Fantastic. And yet, for the mainstream, "supply" remains the culprit.

As a side note, again, there is no denying that supply components have played a role, a secondary one. Aside from the malinvestments brought about by cheap money, the politicization of many aspects of the economy here and abroad resulted in the disruption of the division of labor, ventilated through supply chains. But still, how can prices of goods and services generally rise when financing (money and credit) is limited? Has it?

To return to the issue of bank lending. But what prompted the change in behavior in the banking system?

In our humble analysis, aside from the BSP's historic liquidity injections in 2020-2021, the various relief measures allowed banks to camouflage their actual health conditions to the public.

Rising rates, which translated to asset losses on their fixed-income portfolio, also meant that banks could not count on deposit subsidies, akin to the 2020-2022 episode, from the BSP via repressed official policy rates. That said, bank lending represented the only option to generate cash flows and income.

And so, they were compelled to lend.

And besides, why shouldn't bank lend when they could be motivated by the "moral hazard" that the BSP will back them up from losses? Wouldn't this encourage them to become bolder and take unnecessary risks?

III. Historic Monetization of Public Debt by Banks and Financial Institutions!

Banks and other financial institutions also infused unprecedented liquidity into the system by acquiring public debt.

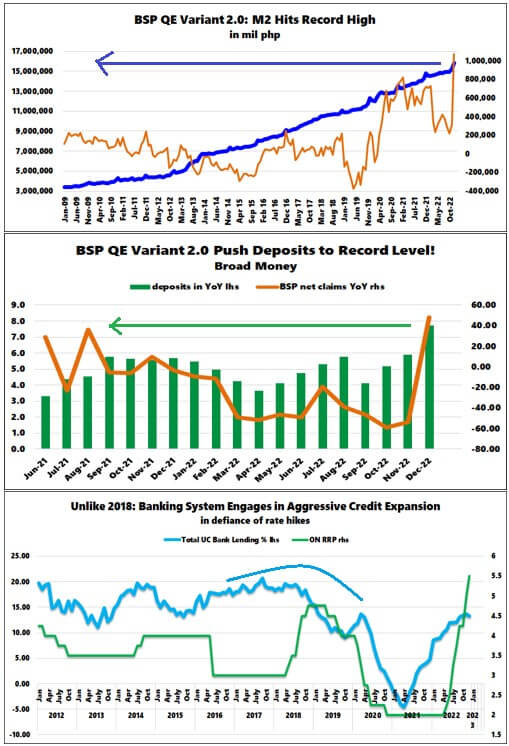

Figure 2

The banking system's net claims on central government also attained an ATH in peso last December! (Figure 2 upper window)

Banks added Php 409.23 billion (MoM) in public debt holdings that hit a record Php 4.551 trillion. The December MoM operations signified the largest in history! (Figure 2, lowest window)

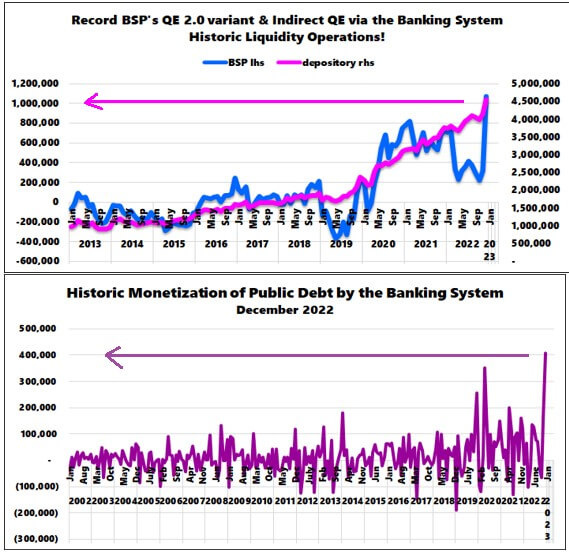

Figure 3

The net claims on the central government of Other Financial Corporations (OFC) also reached an ALT in the 3Q 2022! OFCs added Php 134.013 billion Quarter-on-Quarter (Q-o-Q) over the same period. (Figure 3, upper chart)

Based on preliminary results of the Other Financial Corporations Survey (OFCS), the domestic claims of the OFCs grew by 3.3 percent in Q3 2022 to ₱7,493.8 billion from ₱7,256.1 billion in Q3 2021. The OFCs’ domestic claims increased during the quarter due to their higher claims on the central government and the other sectors. In particular, the OFCs’ claims on the central government rose, following the increase in their holdings of government securities. Similarly, the OFCs’ claims on the other sectors grew slightly, owing to the increase in loans extended to the private sector, i.e., the households and nonfinancial corporations. (BSP, 2023)

So, the aggregate increase in the net claims on central banks from banks and the BSP was a stunning Php 1.16 trillion! OFCs have yet to publish their 4Q activities.

And so, if we read the BSP right, forcing down rates represented the primary objective for this stealth reopening of the monetary spigot.

As evidence, even as the BSP predicts an elevated CPI in January, yields of the benchmark BVAL 10-year Philippine bonds dived faster than the US counterpart. (Figure 3, lower pane)

But bank lending will eventually slow.

The law of demand states that, at a higher rate, consumers will demand a lower quantity of credit.

More than half of the banking system’s balance sheet and over 70% of the industry's total operating income emanate from credit operations.

The second source of income and assets come from investments, which account for about a quarter of their assets and over a fifth of their income.

So in anticipation of this, bolstering asset prices has likely been the target of the torrent of liquidity operations. That is, should lending operations drop, the BSP wants banks to earn from their investments.

Hence, the stealth liquidity operations.

Figure 4

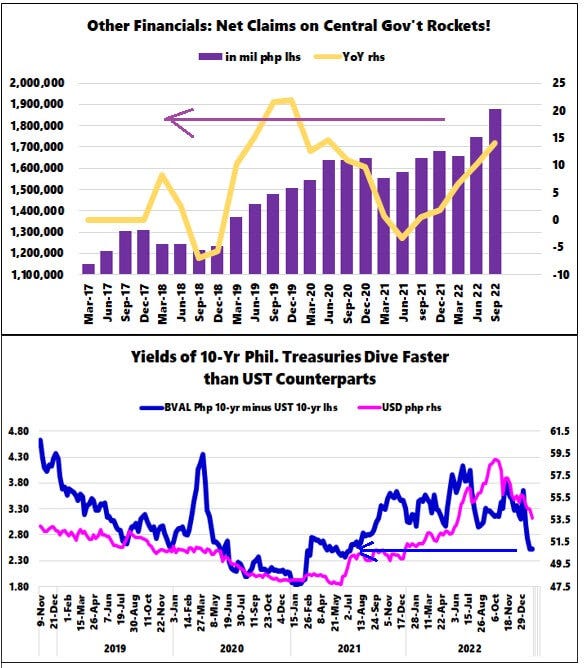

To further my earlier comment, money supply growth in different aspects relative to the GDP jumped in Q4 2022. (Figure 4, topmost chart)

But of course, even the BSP knows of the risks of excessive liquidity operations.

More liquidity though can create its own challenges. The injection of liquidity is an adrenaline to the system to counter the slowdown brought about by the crisis. But there is always that concern that too much liquidity will fuel inflation, and that high inflation can be persistent rather than transitory. This is the debate that we hear more in AEs. It reflects the balancing act between the benefits today of add-on liquidity versus the risks tomorrow of retaining too much of it. (BSP, 2021)

It shouldn't be a surprise that a meaningful time-lagged correlation exists between the growing role of M2 in the economy and the CPI, should it?

To which the CPI responded belatedly to the accelerated expansion of M2/GDP in 2020.

Meanwhile, both have trended up since 2014, at least. (Figure 4, middle window)

And as noted earlier, the PSEi 30 and the PSE have benefited from this BSP-induced liquidity windfall. (Figure 4, lowest pane) Aside from foreign funds operating on the backdrop of a weak USD dollar, domestic financial institutions may have spearheaded the frenzied pumps.

IV. Peak Bank Consumer Debt? Peak Consumer Demand?

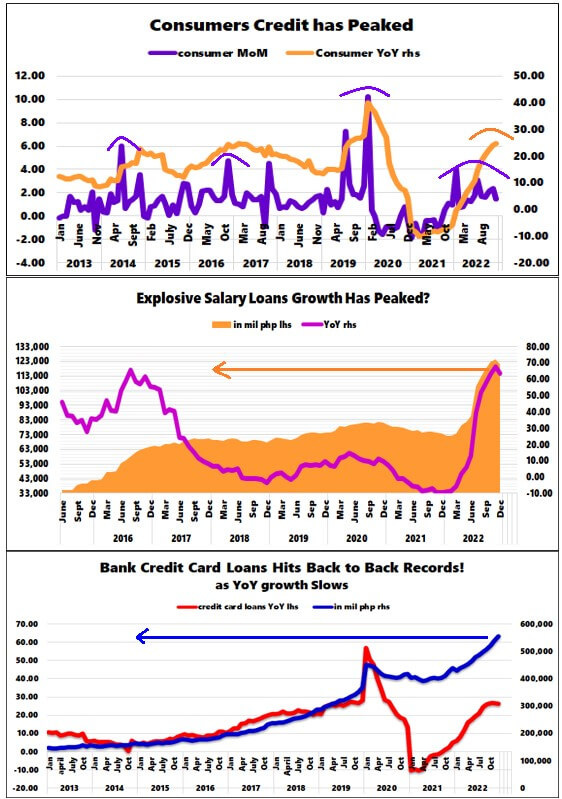

Figure 5

If consumer credit represents one of the principal metrics, then December activities could extrapolate to a possible peak in consumer demand.

Bank consumer credit ballooned by another sizzling rate of 22.8%, but the growth rate appears to be slowing. The MoM growth rate clocked at 1.46%, the lowest in the last six months. Both YoY and MoM seem to be inflecting or showing signs of growth exhaustion. (Figure 5, topmost window)

Though credit card loans sculpted another ATH in peso, the December YoY growth was 26.32%, slightly lower than 26.62% in November. (Figure 5, lowest chart)

The explosive salary loan growth turned marginally down from the ATH in November in peso, and though still a scorching pace of expansion, December (63.8% YoY) was also down from a month ago (67.4%). (Figure 5, middle chart)

The increase in the interest rate cap on credit cards will likely weigh on their usage. That's aside from the rate increases in other areas of bank credit in the face of rising leverage.

Therefore, one should expect 2023 to see a slowdown in consumer spending. And the mainstream appears to be catching up.

V. Reality is not Optional: The Greatest Experiment on our Financial System and the Economy

Let us conclude by interpreting the stated facts. Or, let us "play the cards we are dealt with."

Some questions need answering:

1. Does the string of ATHs of banking and monetary data from interventions reveal "normal" times?

2. What do all these say about the health of the banking and financial system?

3. If the interventions were effective, why the need for escalating interventions?

4. How do these interventions dovetail with the mainstream idea that the economy and the financial system are "sound?"

Or, are they "putting a peg in a square hole?"

5. Does anyone think that in denying these facts, reality becomes optional? Or can personal belief shape socio-economic and financial reality?

Instead, the data set tells me this:

The policy challenge or the struggle to maintain the status quo of a cheap money regime represents the economic development model that protects the entrenched entitlements or privileges of vested interest groups.

Even the political realm demonstrates this phenomenon. Do "political dynasties" and "oligarchies" ring a bell? And has technocracy not become a vital force in policy decision-making? Think pandemic policies. How about the war on drugs?

Because of diminishing returns, policy interventions beget even more interventions.

The applied solution to the backlash from previous interventions has been more interventions.

Aside from the historic financial liquidity and operational interventions, the centralization of the financial system reflects the subtle centralization of the economy. (Prudent Investor, 2023)

How did this happen? The curt answer: by a flood of public spending, regulations, and mandates.

That is, the direction of socio-political-economic policies exhibits the end goal of attaining state capitalism (neo-socialism) or economic fascism.

Has the share of public spending not been rising faster than its private sector counterpart?

There may be areas where liberalization has taken place, but the class of investments seems designed for "ribbon-cutting" purposes.

Yet, how will the grassroots flourish when the stream of incumbent policies exists to strip mine our savings and when taxes, regulations, and mandates stifle their ability to engage in entrepreneurship? Hasn't the small-and-medium scale enterprises (SMEs) represented the biggest employers?

Worst, the framework of interventions escalates in scale and time. Aside from financials, have 2022 fiscal deficits not been in proximity to its 2021 record? Has public debt not reached a new milestone in 2022?

All. Time. Highs.

In sum, the kernel of our thesis: Political authorities have been piling into or escalating interventionist experiments, which we capture here as financial and monetary interventions. Such interventions represent an unprecedented or the "greatest" experiment on our financial system and economy.

Greatest. Experiment. Ever.

Yet, are they aware of the complexity of the variability of interdependent and overlapping feedback loops over different time frames (intertemporal effects)? Or are they making it up as they move along?

What would be the outcome of short-term fixes? Economic and financial stability or instability?

How does a trader or investor deal with this?

We live in interesting times.

____

References

Prudent Investor Newsletter, The BSP Unveils Stealth QE 2.0 (Variant)! January 15, 2023 blogger, substack

BSP, Domestic Claims of Other Financial Corporations (OFCs) Increased by 3.3 Percent YOY in Q3 2022, January 31, 2023 bsp.gov.ph

FINANCIAL STABILITY COORDINATION COUNCIL, 2nd SEMESTER 2021 FINANCIAL STABILITY REPORT, page 5 bsp.gov.ph

Prudent Investor Newsletter, The Centralization of the Philippine Banking System Magnifies Concentration and Contagion Risks, January 23, 2023, blogger, substack