Banks Rule the PSEi 30’s 3.85% Low Volume Weekly Rally (July 14)

The Philippine PSEi 30 soared mainly from its banking components, which ironically deviated from the performance of non-PSE banks and the other non-financial sectors. Is this sustainable?

The whole profit of the issuance of money has provided the capital of the great banking business as it exists today. Starting with nothing whatever of their own, they have got the whole world into their debt irredeemably, by a trick. This money comes into existence every time the banks 'lend' and disappears every time the debt is repaid to them. So that if industry tries to repay, the money of the nation disappears. This is what makes prosperity so 'dangerous' as it destroys money just when it is most needed and precipitates a slump. There is nothing left now for us but to get ever deeper and deeper into debt to the banking system in order to provide the increasing amounts of money the nation requires for its expansion and growth. An honest money system is the only alternative—Frederick Soddy, (1877-1956) British author, professor, Nobel Prize for Chemistry, 1921

In this issue

Banks Rule the PSEi 30’s 3.85% Low Volume Weekly Rally (July 14)

I. Financials Dominated the PSEi 30’s Low-Volume Rally

II. Divergent Performance Between PSEi 30 and Non-PSEi 30 Banks

III. Financial Index: The Roadblocks to a Sustained Trend Breakthrough

IV. Booming Bank Shares: Is This Time Different?

V. Why the Outperformance of the Financial Index?

___

Banks Rule the PSEi 30’s 3.85% Low Volume Weekly Rally (July 14)

I. Financials Dominated the PSEi 30’s Low-Volume Rally

Financials championed this week's low volume 3.85% rally.

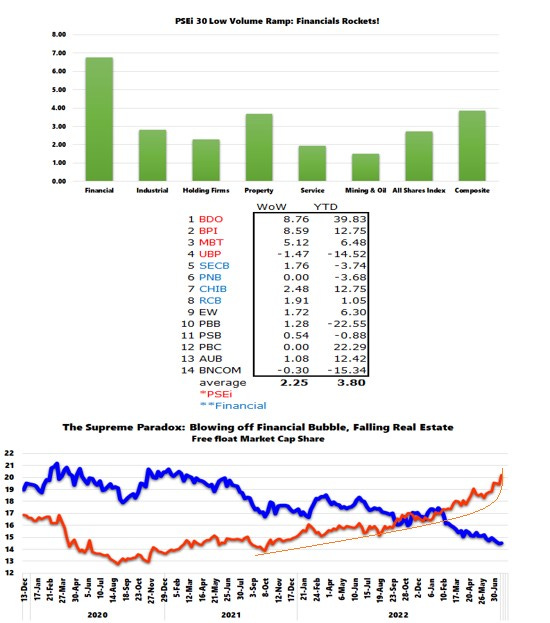

Figure 1

Financials rocketed by 6.75%, followed by the property and Industrial sectors which also jumped 3.67% and 2.8%. (Figure 1, topmost window)

Two issues, namely BDO Unibank [PSE: BDO] and Bank of the Philippine Islands [PSE: BPI], powered the gains of the PSEi 30 and the outperformance of the Financial Index with a weekly spike in returns of 8.76% and 8.59%, respectively.

Shares of most banking issues were up for the week, but only UBP (-1.47%) declined among the members of the PSEi 30 and the 9-issue Financial Index. (Figure 1, middle table)

This discussion excludes small-cap banks, City Savings Bank [PSE: CSB], Philippine Trust Bank [PSE: PTC], and the Philippine Stock Exchange [PSE: PSE] as the sole non-bank member of the Financial Index.

Since BDO and BPI have the largest share weight in the Financial Index, with 38.6% and 28.24% as of July 14, their weekly gains resonated with the latter’s returns.

Similarly, following the upsurge in the share prices of BDO and BPI, their aggregate weight, including MBT, now commands a stunning 20.3% share of the PSEi basket (as of July 14)! (Figure 1, lowest window)

The thing is, outside this week's euphoria, only five of the 14 listed issues have delivered returns of over 12% YTD. Six issues have yielded losses YTD.

II. Divergent Performance Between PSEi 30 and Non-PSEi 30 Banks

Figure 2

The chart of the banks depicts the divergent performances of its members. (Figure 2)

The charts exclude the Philippine Bank of Commerce [PSE: PBC]—due to the lack of trading activities.

BDO, BPI, and CHIB are the only banks with share prices in an uptrend. The rest are drudging within their respective trading ranges.

There's no denying that a rising tide may lift all boats, but there are many reasons to doubt these, including the lack of savings/volume.

III. Financial Index: The Roadblocks to a Sustained Trend Breakthrough

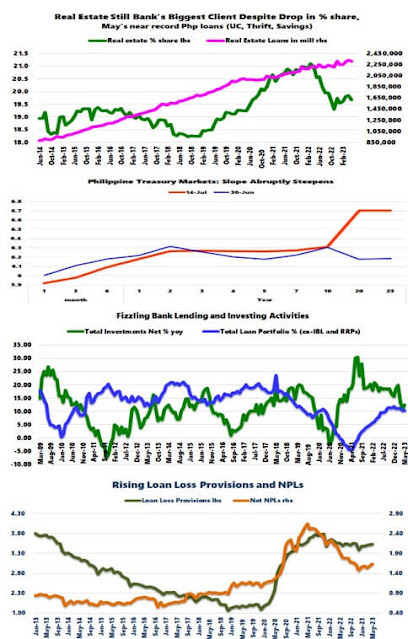

To begin with, while the trio's pie appears to be in a blowoff phase, the % share weight of the property sector operates in the opposite direction.

Figure 3

The real estate sector remains the largest client of the banking system.

Total bank loans to the supply-side sector reached Php 2.315 trillion last May. Although the share of this supply-side loan portfolio has recently dropped, it remains the most significant (19.7% for Total Banks, 20.1% for Universal and Commercial banks). (Figure 3, topmost graph)

The thing is, should the real estate sector suffer from diminished sales, reduced liquidity, or the emergence of insolvencies, these should impact the banking system's portfolio and financial standings.

Second, the abrupt steepening of the Philippine yield curve—even before the Philippine CPI announcement—could have induced the binge buying on key bank issues. (Figure 3, second to the highest chart)

The idea is that an inclined slope translates to higher net margins for banks.

But higher rates have started to impact the industry's balance sheet.

As cash holdings continue to slide, bank lending and investment growth appear to have stalled. (Figure 3, second to the lowest window)

And with it, published NPLs have started to U-turn to the upside. (Figure 3, lowest chart)

Figure 4

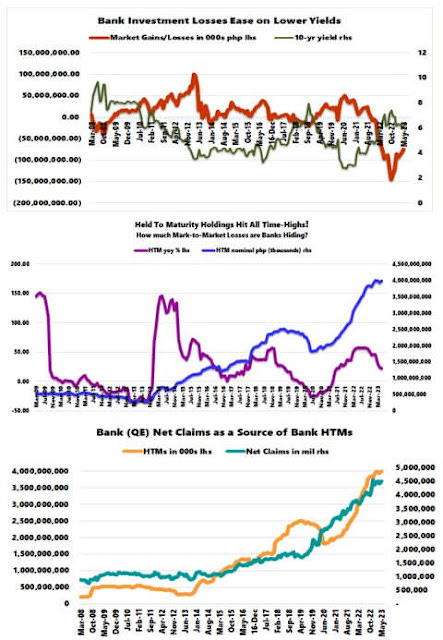

Treasury yields have slipped, which eased the industry's investment losses. (Figure 4, topmost window)

But still, even as Treasury yields slid, Held-to-Maturity (HTM) assets hit a fresh record high last May, but growth rates have been slowing. (Figure 4, middle chart)

In any case, banks continually use HTMs to conceal the mark-to-market values of their fixed-income securities, which have risen in tandem with their milestone acquisition of government securities. (Figure 4, lowest chart)

Despite all the support provided by the government to save the banks coming at society's expense, what have been the genuine conditions behind those statistics?

Besides, why the need for such support, if the industry's health has been "sound?"

IV. Booming Bank Shares: Is This Time Different?

And what has changed for banks to break previous economic and financial relationships?

Figure 5

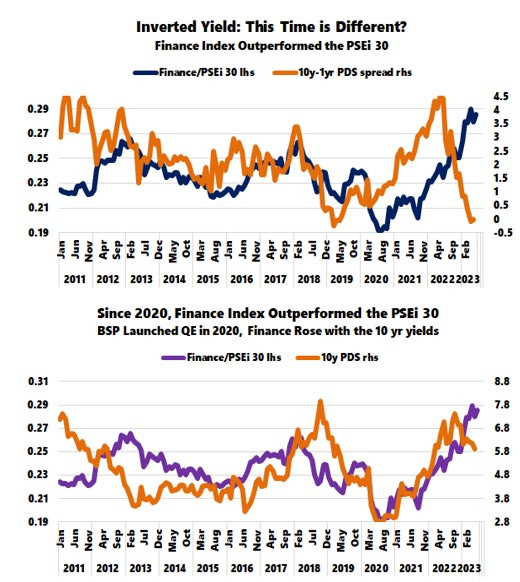

In the past, a flattening curve has resulted in the underperformance of bank shares relative to the PSE. (Figure 5, upper graph) With the correlations broken, does this mean "this time is different?"

Or could banks' shares have been bid due to excess liquidity despite the uptrend in yields? (Figure 5, lowest chart)

Figure 6

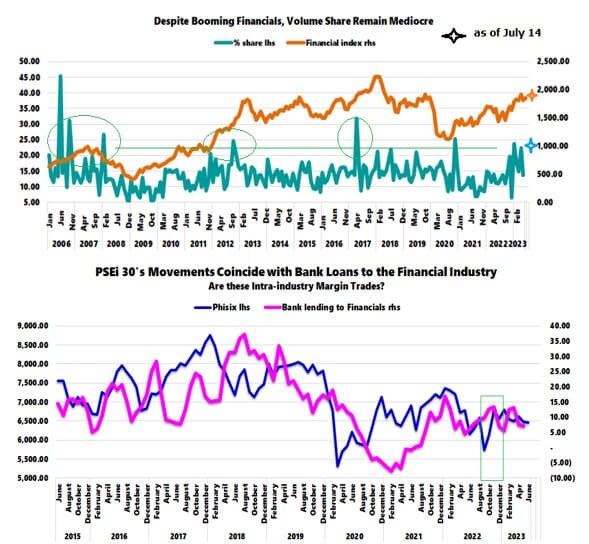

And even as banks have outperformed the PSE, transactions or turnover as a share of the total has been mediocre. As of July 14, while the Financial Index reached 1,939.83, its share of the pie signified 23.03% of the gross turnover. (Figure 6, upper chart)

And there you have it, even as the % share of Financials has gone vertical, volume remains significantly off the 2006-7, 2012, and 2017 levels.

Is this time different?

V. Why the Outperformance of the Financial Index?

So why has the financial index outperformed?

We can only guess from the clues provided.

One. It's SONA time! (July 24th)

Domestic financial markets should convince the world that the administration has a good grip on the economy. Perhaps the BSP has made sure that this has to be the case.

For instance, the BSP cut the banking system's Reserve Requirement last June 30. Has the industry used a portion of this to bankroll the bank equity buying spree? If so, great timing!

Will the surge in the PSEi 30 be used to justify to the public the enactment of the Philippine version of the Sovereign Wealth Fund (SWF), the Marharlika Investment Fund?

Yet, the divergent bank equity share performance favoring the elite members of the PSEi 30 could signify "circumstantial evidence" to prop the index up.

Two. The gyrations of the PSEi 30 have tightly coincided with the YoY bank lending to the financial sector. (Figure 6, lowest chart)

Could this imply that banks and non-financial institutions have levered up their balance sheets to buy bank equity shares?

Three. The BSP recently admitted that OFC (Other Financial Corporations) were substantial buyers of bank shares in Q4, 2022: "In particular, the OFCs’ claims on DCs expanded owing mainly to the growth in the sector’s deposits in banks and holdings of bank-issued equity securities."

In Q4 2022, bank lending to the financial sector gained momentum as the PSEi 30 rallied to narrow its deficit. Returns of the financial sector surged 12.17% QoQ.

Could the non-bank financials, under the tacit behest of the BSP, be doing the same thing again?

We close this outlook with a renowned quote from the late American economist Herb Stein, "If Something Cannot Go on Forever, It Will Stop."